UniCredit Bank

debit card

Debit Card

-

Discover UniCredit Bank debit card benefit packages

At UniCredit you can have debit cards to suit different needs in your life.

If you need a way to manage money from your salary or pension, you want to teach your children about money management since childhood or you simply need a virtual card for online payments, you can benefit from the advantages of the debit cards in our offer.

Salary card

Pension card

Children's card

Virtual card

Virtual Debit Card

The Standard and Gold virtual cards give you full and permanent access and control over your account from anywhere - at home or abroad. In addition to the benefits you get with a physical debit card, Standard or Gold, a virtual card brings many other advantages:

- Available for individuals, account holders in EUR and RON, over 18 years old;

- Up to 5 virtual cards can be issued attached to each RON and EUR account held by the customer, maximum 2 virtual cards per day;

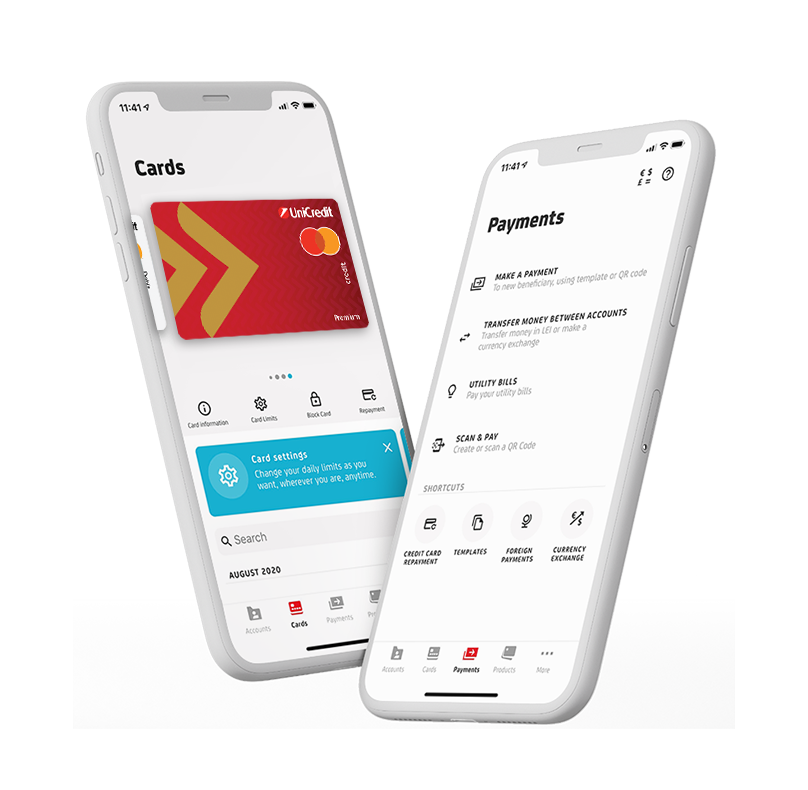

- Issuing and closing of the virtual card is done instantly from Mobile Banking;

- Virtual card management is 100% online via Mobile Banking, available 24/7 (lock/unlock, change limits, close);

- In order to be able to use a UniCredit Bank virtual card, it is necessary to have the Mobile Banking application active;

- The virtual card cannot be used at ATMs for balance inquiries or cash withdrawals;

- Available for enrollment in GooglePay/Apple Pay for POS transactions and can be used for internet transactions, secure and convenient, with no fees;

- No PIN required and transactions are authorized as follows:

○ at the POS using the password used to access the mobile phone;

○ on the Internet, by 3D Secure authorization, for which you can find more details here.

Download the Mobile Banking app to request the issuance of the virtual card

How do you choose the debit card you need?

So many possibilities. Tough choice?

Not at all. The important thing is to know what you want and you'll find a benefits package that fits your needs. A debit card is always linked to a current account, so if you're not a UniCredit customer we recommend you keep an eye out for current account offers.

To make your choice even easier, you can compare the benefits of debit cards by visiting the comparison tool.