6% interest, 100% opportunity

Term deposits

Open a term deposit in Lei for 6 months, with automatic renewal, through Mobile or Online Banking, and you can benefit from super interest rates:

-

6% per year for amounts starting from 50,000 Lei

-

5.5% per year for amounts starting from 10,000 Lei

As you well know, good opportunities have a less good habit. They appear rarely and disappear quickly.

Well, today we would like to introduce you to one of these opportunities. You can benefit from an interest rate of up to 6% on term deposits in Lei, with automatic extension, set up for 6 months, through Mobile or Online Banking. More specifically:

![]() 6% interest per year for amounts starting from 50,000 Lei.

6% interest per year for amounts starting from 50,000 Lei.

![]() 5.5% interest per year for amounts starting from 10,000 Lei.

5.5% interest per year for amounts starting from 10,000 Lei.

Efficient

ZERO commision for opening, maintaining and closing the deposit

Flexible

You can choose your preferred savings period: 3 months, 6 months, 12 months

Without worries

You don’t have to worry about renewing at each settling day because you can automatically extend the deposit for a period identical to the prior.

Open a term deposit in Lei from Mobile or Online Banking and enjoy the interest rates!

Interest valid for deposits in Lei newly made through Mobile Banking

Open a term deposit through Mobile or Online Banking and benefit from 0.3 pp in addition to the standard interest granted in the branch, for 3, 6 and 12 months term deposits in Lei.

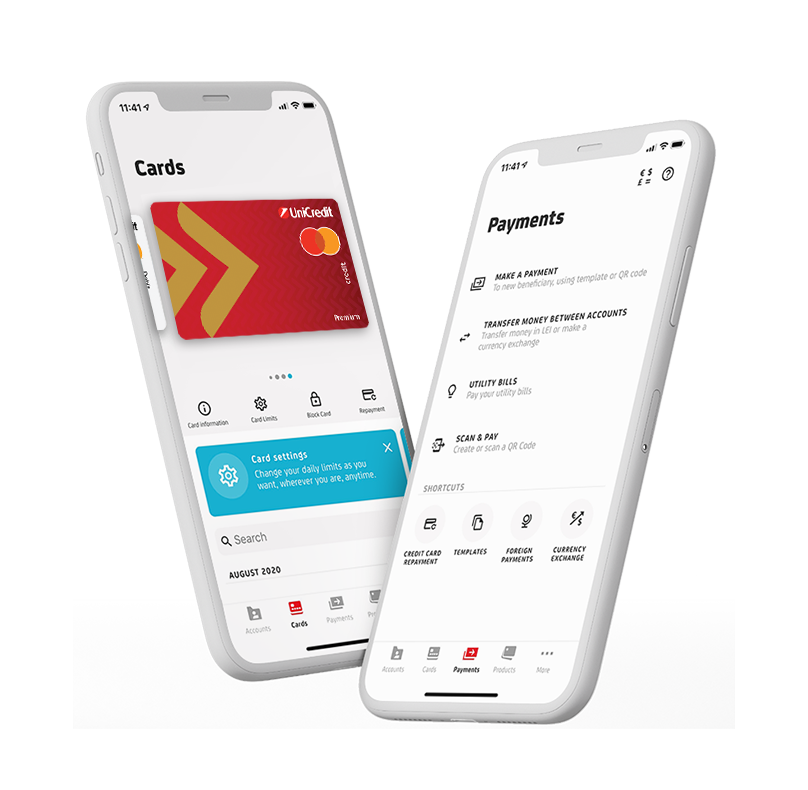

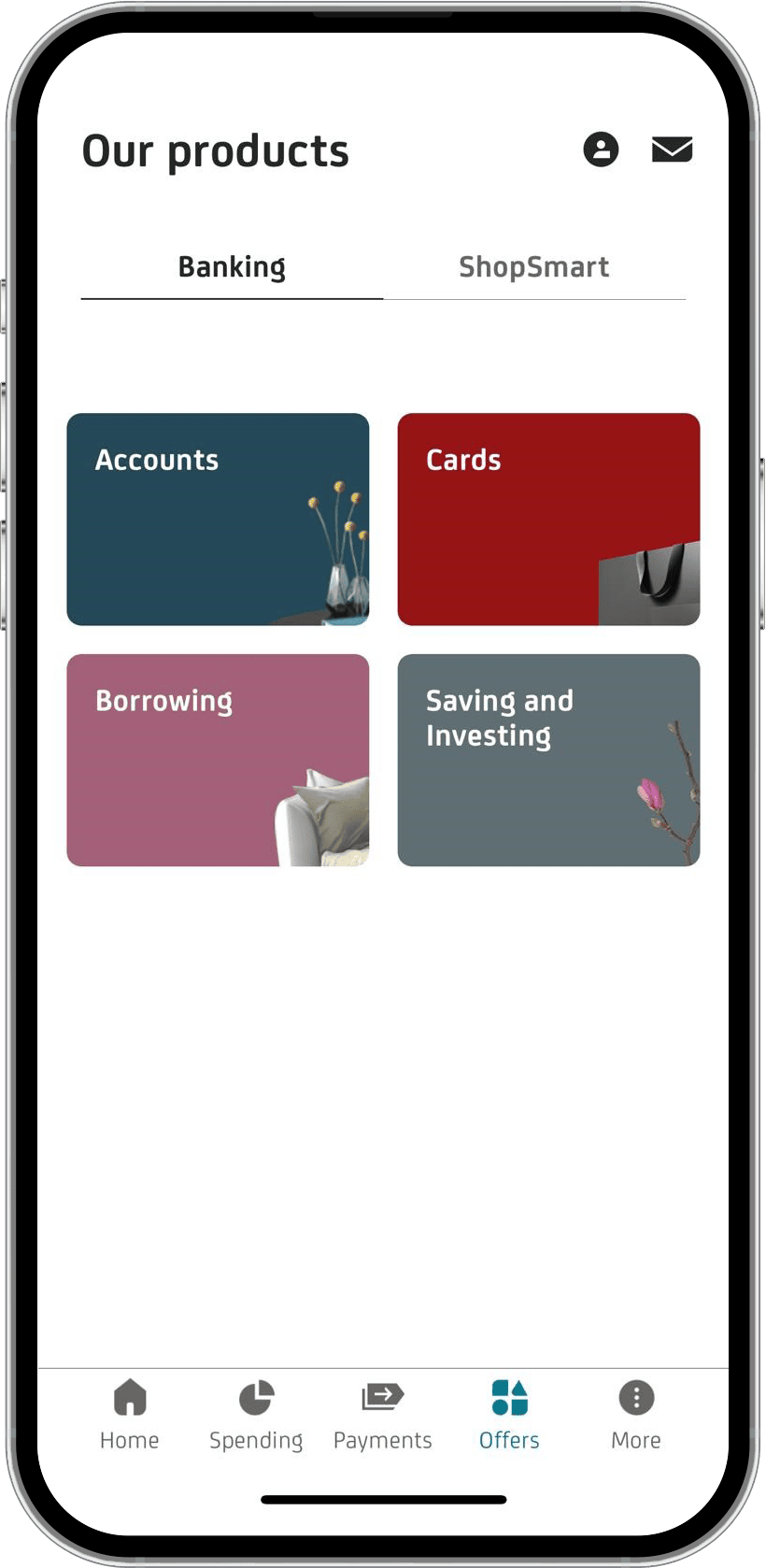

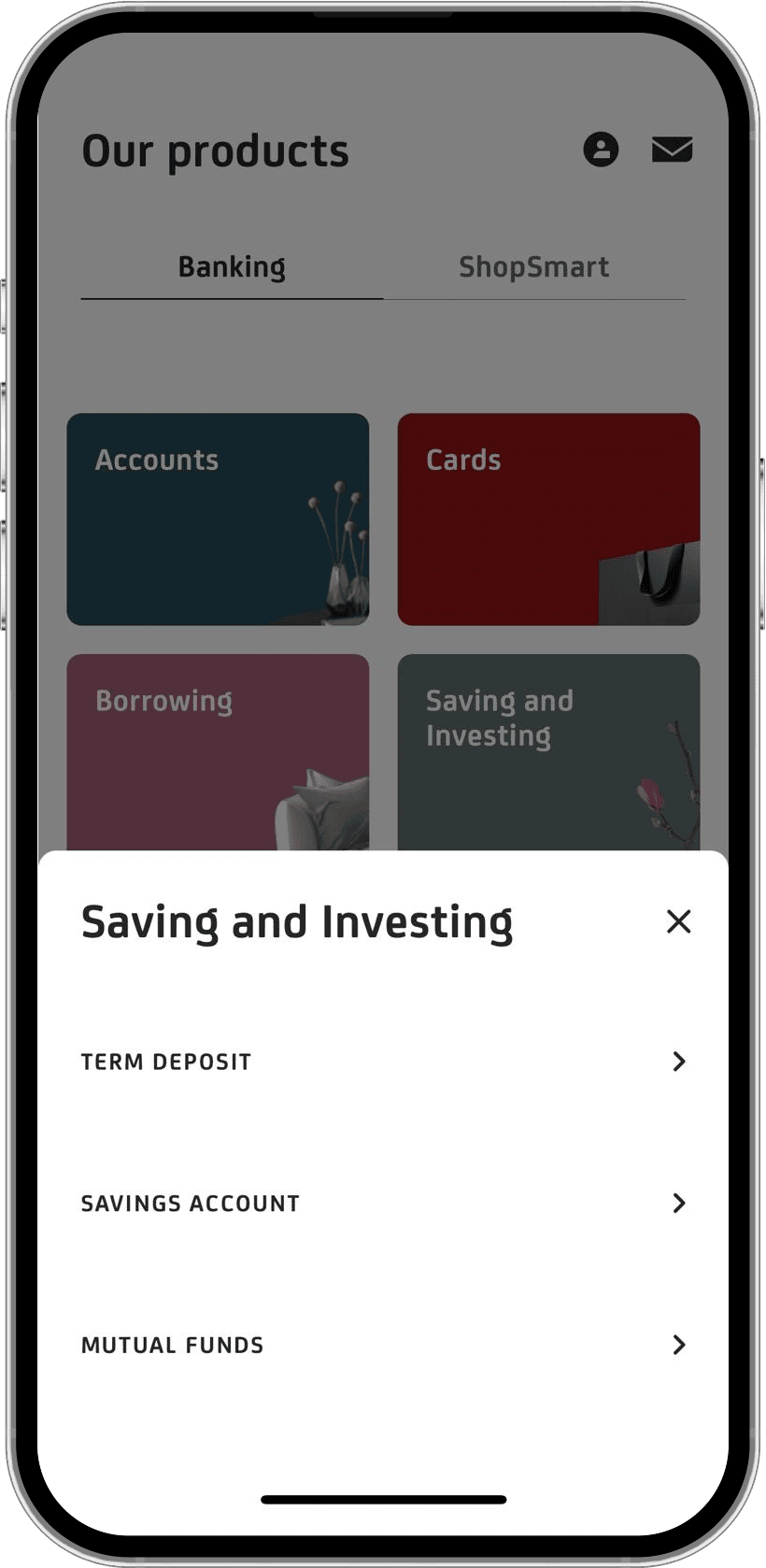

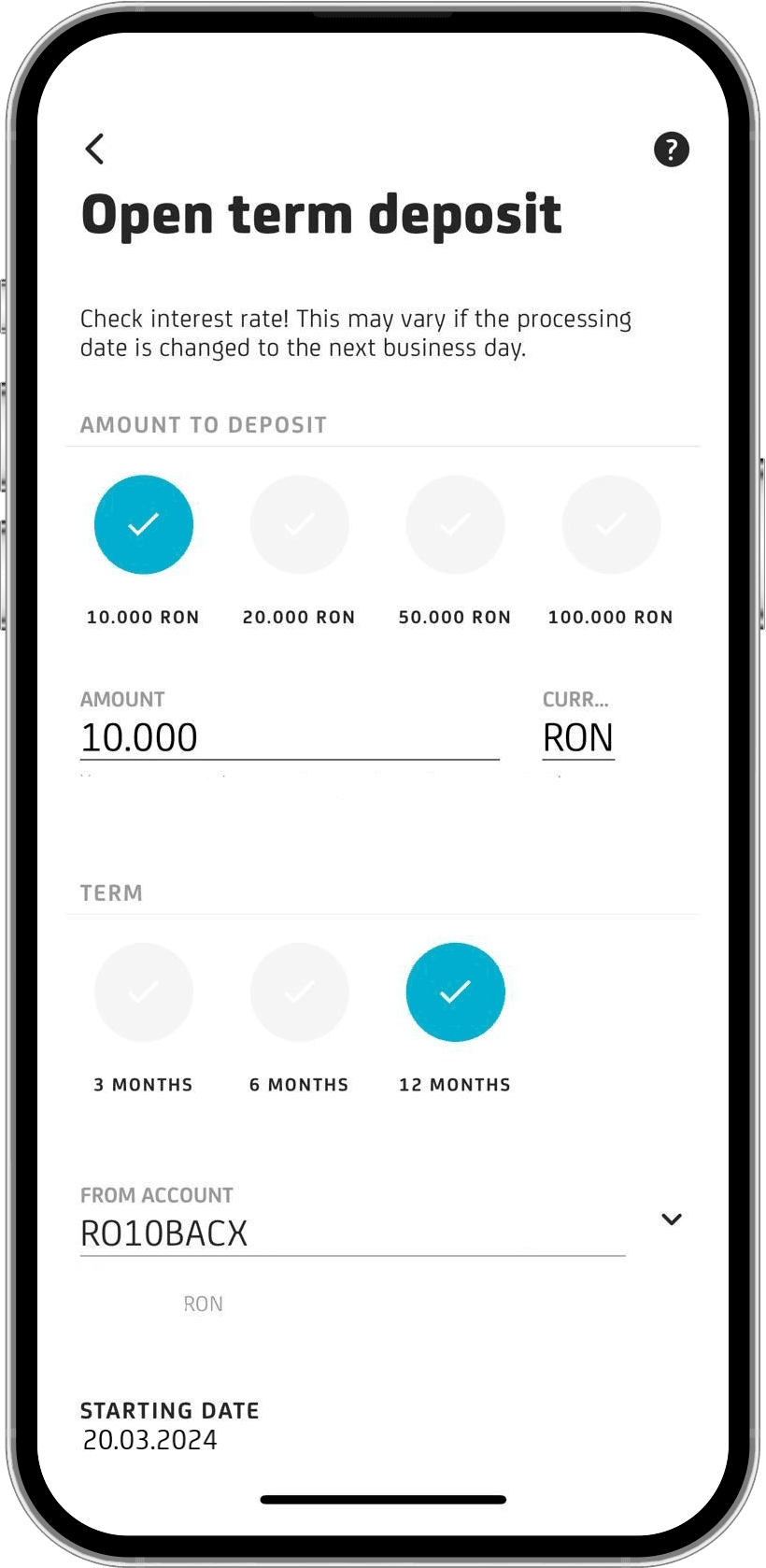

Follow the steps below in order to open a term deposit through Mobile Banking:

1. You should log in to the app, choose the Offers section from the menu and then select Term Deposit.

2. Choose the amount you want to open the deposit with and the deposit period and then select the account you have the money in.

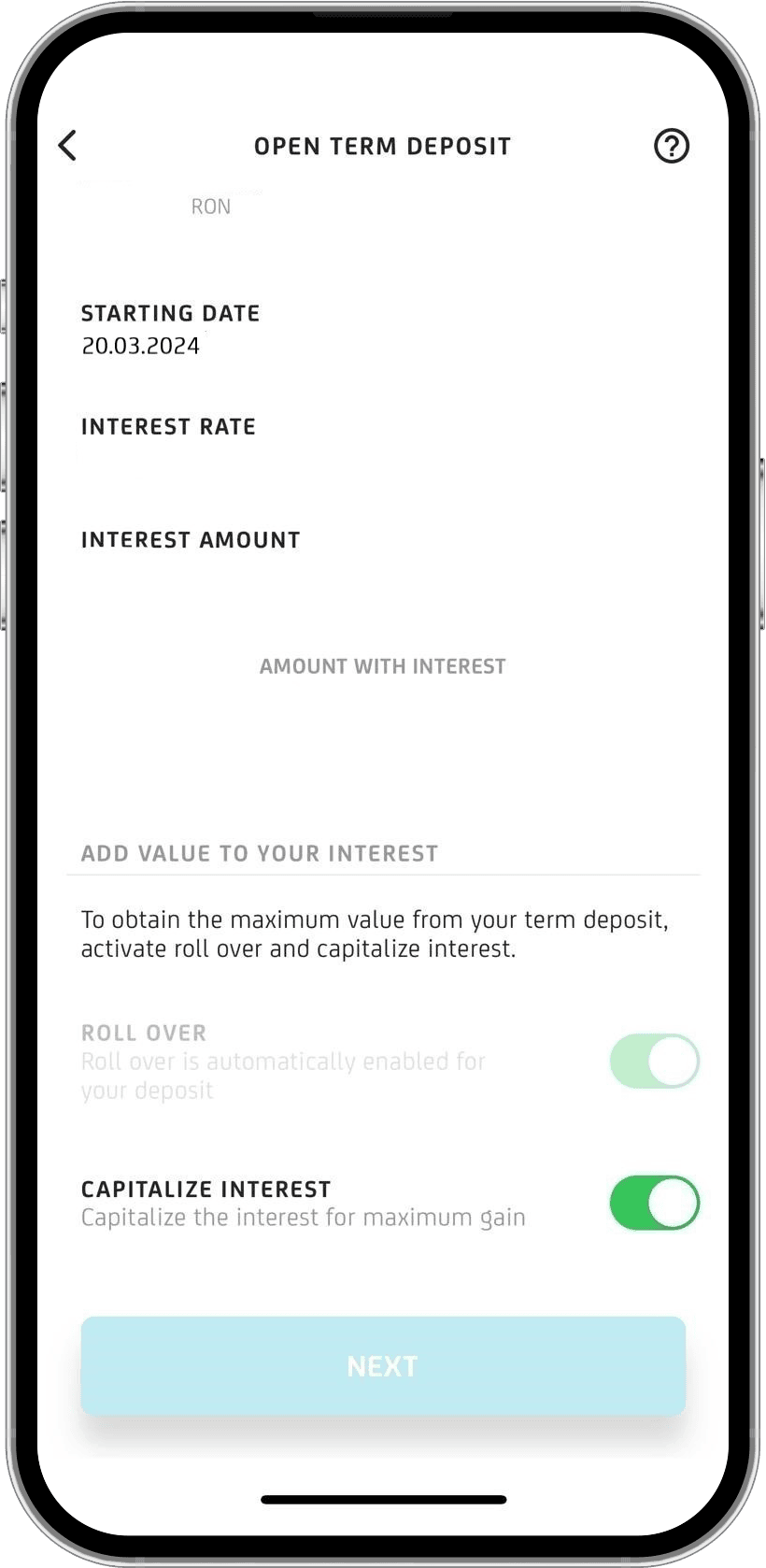

3. You choose whether you want a term deposit with capitalization or not.

4. Check the details, read and accept the terms and conditions and then sign for opening the deposit.

Questions and Answers

| Term deposits with automatic extension and interest rate capitalization (% per year) | |||

| Period |

Created through Online & Mobile Banking |

||

| LEI | EUR |

USD |

|

| 3 months |

5.00 |

2.00 | 2.70 |

| 6 months |

5.10%* / 5.50%** / 6.00%*** | 2.30 | 3.00 |

| 12 months |

5.20 |

2.30 | 3.30 |

* interest applicable for deposit amount <10,000 Lei

** interest applicable for deposit amount ≥ 10,000 Lei and < 50,000 Lei)

*** interest applicable for deposit amount ≥ 50,000 Lei)

For term deposits with LEI fixed interest rate on 3 and 12 months opened in branch is applied the interest rate for Online Banking & Mobile Banking Deposit minus 0.30 percentage points.

For term deposits in Lei with fixed interest for 6 months set up in the branch, the interest rate is 5.10%/year minus 0.30 percentage points, regardless of the amount of the deposit.

For term deposits in Lei with fixed interest for 6 months set up in the branch by customers who benefit from the PENSIONER offer, the applicable interest rate is 5.10% per year, regardless of the amount of the deposit.

For term deposits with EUR fixed interest rate on 3, 6 or 12 months opened in branch is applied the interest rate for Online Banking & Mobile Banking deposit minus 0.10 percentage points.

For term deposits with USD fixed interest rate on 3, 6 or 12 months opened in branch, is applied the interest rate for Online Banking & Mobile Banking deposit minus 0.10 percentage points.

UniCredit Bank S.A. deposits are protected by Bank Deposit Guarantee Fund. The guarantee maximum limit is the lei equivalent of 100,000 euros per depositor, per bank.