Savings account

You save easily, at your own pace, without losing the interest accumulated in your savings account

APPLY ONLINEFrom now on, it is easy to save for your plans in a savings account from UniCredit Bank.

Open a free savings account in lei, euros, or dollars and start setting aside money for everything you want, now easier than ever.

Don't put off until tomorrow what you can save today!

Advantages of a UniCredit Bank savings account:

ZERO FEES

To open, manage or close your savings account

FLEXIBLE

You have permanent access to the money in your savings account and there is no minimum amount required to open and maintain the account. You can deposit or withdraw money whenever you need, without losing the accumulated interest

SIMPLE AND EASY

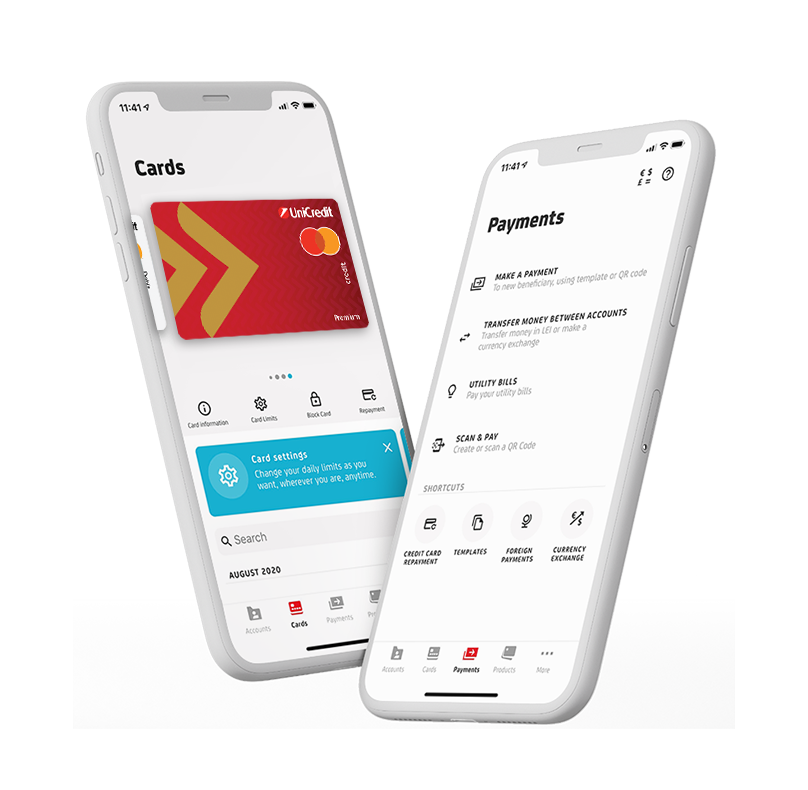

You save at your own pace and effortlessly by activating a free scheduled payment that will automatically transfer an amount of money set by you from your current account to your savings account. You can open a savings account in LEI, EURO or USD without going to the bank, using the Mobile or Online Banking applications*

What interest do I receive?

| Interest rate (% / year) | ||

|---|---|---|

| LEI | EUR | USD |

| 2,50 | 0,50 | 1,00 |

The interest will be calculated on the daily balance of the savings account and will be transferred monthly to the current account or will be capitalized in the savings account, according to your option.

For interest income related to savings instruments, the bank is obliged to withhold interest tax at source by applying the following rates:

![]() 10% in the case of individuals residing in Romania, in European Union member countries or in countries that are not members of the European Union, but with which Romania has concluded a Double Taxation Convention;

10% in the case of individuals residing in Romania, in European Union member countries or in countries that are not members of the European Union, but with which Romania has concluded a Double Taxation Convention;

![]() 16% in the case of individuals residing in countries that are not members of the European Union and with which Romania has not concluded a Double Taxation Convention;

16% in the case of individuals residing in countries that are not members of the European Union and with which Romania has not concluded a Double Taxation Convention;

![]() a more favorable rate, if it is provided by the convention for the avoidance of double taxation concluded by Romania with the state of tax residence, if the non-resident client presents a tax residence certificate, in original, valid in the year of interest payment.

a more favorable rate, if it is provided by the convention for the avoidance of double taxation concluded by Romania with the state of tax residence, if the non-resident client presents a tax residence certificate, in original, valid in the year of interest payment.

The savings accounts set up at UniCredit Bank are guaranteed by the Bank Deposit Guarantee Fund (FGDB). The guarantee ceiling represents the equivalent in RON of the amount of EUR 100,000 per depositor, per bank.

*Online Banking - internet banking service

Children take the first steps in managing their own finances with their parents.

The little ones will gain confidence in their own financial decisions and will prepare for the moment when they will have the freedom to decide for themselves how to manage their resources.

Ensure your child's carefree future by saving for him in a Junior Savings Account from UniCredit Bank. This children's savings account is opened directly in the child's name and is available in lei, euros or dollars.

You can activate a scheduled payment for free that will automatically transfer an amount of money set by you from your current account to the Junior savings account.

The small amounts accumulated constantly over the years will represent a real financial support for your child.

Advantages of a Junior savings account:

ZERO FEES

To open, manage or close your children's savings account

FLEXIBLE

Permanent access to the money in the savings account, without the need for a minimum amount to open and maintain the Junior savings account; Deposits or withdrawals of money at any time, without losing the accumulated interest

SIMPLE AND EASY

With a children's savings account you can save for your child at the pace of your choice and effortlessly. You can activate a scheduled payment for free that will automatically transfer an amount of money set by you from your current account to the Junior savings account

Ce dobanda primesti pentru Contul Junior?

| Interest rate (% / year) | ||

|---|---|---|

| LEI | EUR | USD |

| 2,50 | 0,50 | 1,00 |

You saving accounts are secured by the Bank Deposit Guarantee Fund (FGDB).