Bank fraud

How to protect yourself against it

What is a bank fraud and how can it affect you?

Bank fraud means any attempt to trick you to obtain money or personal information. It can appear in various forms – deceptive messages, suspicious calls, or hidden methods to gain unauthorized access to bank accounts. Be careful and protect your data!

Need help? Report any suspicious activity:

E-mail: infocenter@unicredit.ro

Phone: +40 21 200 2020

Blocking card: 0800 888 111

- Avoid replying to messages that requires personal or financial information. If you receive messages asking for personal information or a link, ignore them. It could be a sign of bank fraud.

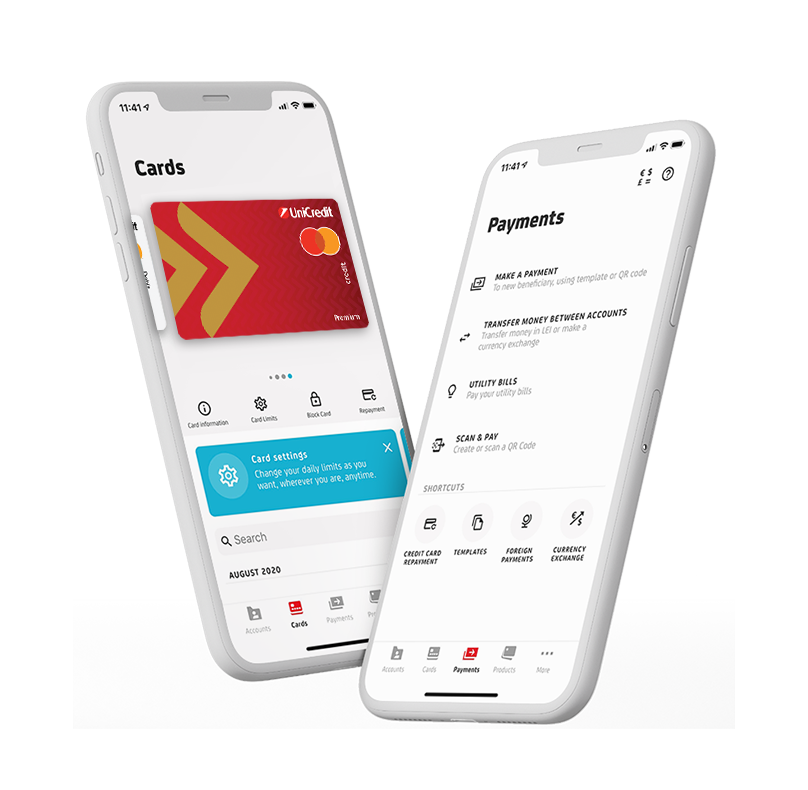

- Don't install apps or access suggested sites received through unsolicited phone calls or messages.

- Make sure you access banking apps directly from official sources, such as the bank's website or mobile app, and not through links received via SMS or email.

How do you recognize and prevent various types of bank fraud?

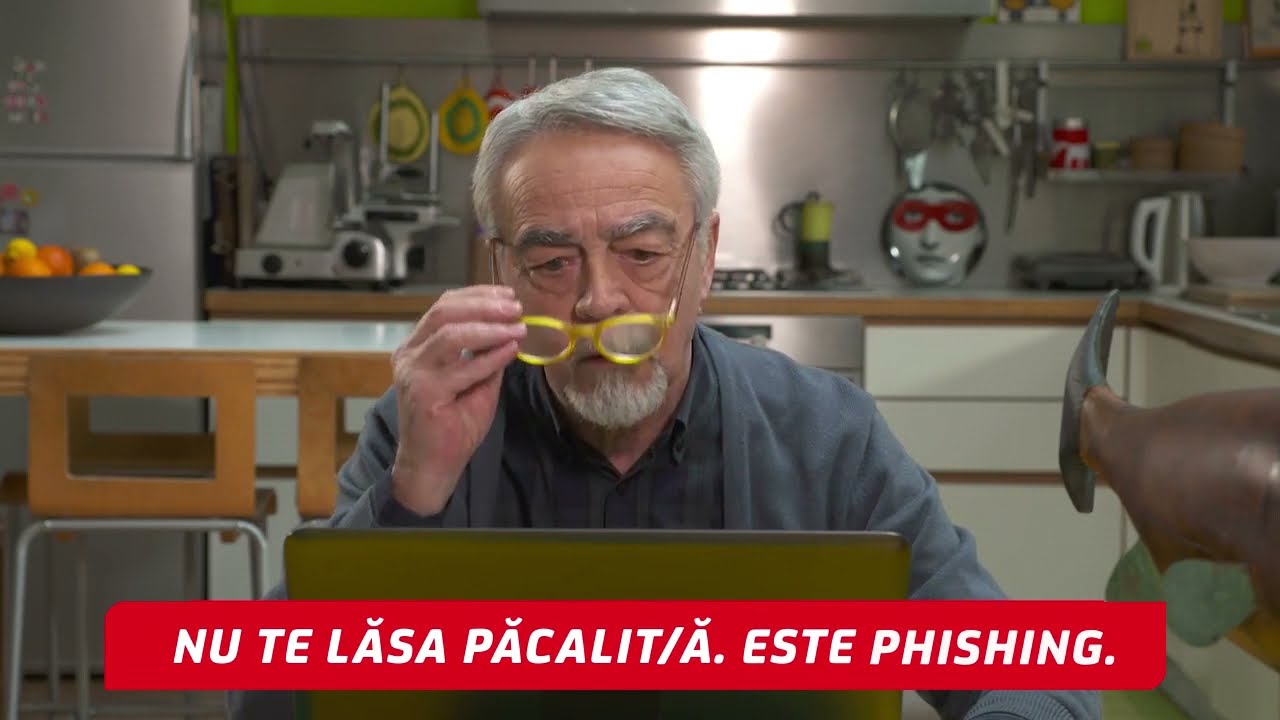

Phishing and Smishing (suspicious emails and SMS):

How happens?

- You receive messages asking you to record your card details or passwords or

- You receive links that lead to webpages that look like the bank's website (even though you're not that bank's customer or haven't requested any additional products), but it's a fake site.

How to protect yourself from this type of fraud: Don't provide personal or financial data. Report any suspicious messages, emails or accounts to the competent authorities and to the bank.

Spoofing (fake phone calls):

How happens: Someone calls you, pretends to be from the bank and request for the card PIN/ payment applications, other personal data or asks you to transfer some money. The fraudster creates pressure by insisting to act immediately, sometimes suggesting you not to tell anyone about the call, including the bank. Request for as many details as possible about the reason for the received call to make sure that the caller is from the bank.

How to protect yourself from this type of fraud: Hang up the call and call the bank immediately using the official numbers.

Skimming (ATM frauds):

How happens? Attackers stick hidden devices at ATMs to copy your card data (e.g. the keypad or card insertion slot are duplicated/overlapped).

How to protect yourself from this type of fraud:

- Make sure that the ATM does not have traces of vandalism, glue, connected devices or marketing flyer boxes/stands;

- Cover the keypad every time you enter your PIN and avoid ATMs located in isolated areas.

Social media frauds:

How happens? Fake accounts that invite you to share your personal information or make various payments.

How to protect yourself from this type of fraud: Do not discuss personal data on social media platforms and report suspicious accounts directly on the platform.

Frauds related to cryptocurrencies, stock market investments or direct investments in energy/oil/gas companies:

How happens: Have you open ads on Youtube, Facebook or other social networks that have transferred you to dubious sites that requires you for personal data to further be contacted by phone by an investment broker? Have you received offers that promise huge investment gains? It's a trap.

How to protect yourself from this type of fraud: Check the legitimacy of the offer and do not send money or personal data to strangers.

WhatsApp frauds

How happens: Malicious persons who could pretend to be friends, family members or representatives of institutions, under various pretexts, can ask you for a WhatsApp verification code received, they can send you a code with the indication to enter it in the WhatsApp application for device pairing or they can send you a link to a site where it is requested to enter the phone number and a code in the Whatsapp application;

How to protect yourself from this type of fraud: Don't transfer money as a result of the request received through the WhatsApp app. Before making any transfer, make sure that the request based on which you make the transfer is an authentic one, call the person from whom you received the request to confirm!

What can I do if I have clicked on a suspicious link and provide information on payment instruments (card, internet / mobile banking)?

1. Block the card immediately:

You can do this from the Mobile Banking app or by calling the bank's emergency number to report the fraud.

2. Change passwords:

Change passwords where possible for remote payment instruments.

3. Check your device (phone, laptop, computer):

Install and run an antivirus to identify possible threats.

4. Notify the authorities:

Report the incident to the Romanian Police (petitii@politiaromana.ro), the National Directorate of Cyber Security (DNSC) through the PNRISC platform or by calling 1911 and the Bank (infocenter@unicredit.ro).ca (infocenter@unicredit.ro).

How can I stay protected online?

- If something sounds too good to be true, it could be a fraud.

- Don't open attachments or click on links that look suspicious.

- If you're asked for confidential information (banking information, passwords), refuse to provide data until you confirm the authenticity of the message.

- Do not provide your bank card details (card number, CVV code, PIN) to receive money. If someone needs to send you money, they need to ask for your IBAN. The card is used as a payment instrument, NOT as a income tool, unless the merchants will refund the money on your card when you physically return a product!

- Install an antivirus and update it regularly.

- Scan your device if you suspect it may be compromised.

- Check if the website you are accessing is reliable for shopping (the presence of the padlock symbol in the address bar, the payment methods on the site, the MasterCard SecureCode and Verified by VISA logos).

- Do not use the option to remember the card number in your browser.

- Learn how to recognize bank fraud and what steps to take to protect yourself.

- Always check before following up on requests from strangers.

- Get information only from official and reliable sources (e.g. www.dnsc.ro, www.sigurantaonline.ro, www.unicredit.ro the Security section).

Your online safety starts with information and prevention!

If you have any questions or need assistance, the UniCredit team is here to support you.

Questions & Answers

- Ignore urgent requests for personal data, passwords or PINs, it could be a sign of bank fraud.

- So are messages promising quick wins or requesting you to transfer money to "secure" accounts.

- Calls from unknown numbers or from other countries, especially if you don't expect to be contacted.