Personal

Accomplishments Loan

Refinancing with FIXED INTEREST RATE through a loan from UniCredit Consumer Financing, with annual fixed interest from 5.99%.

Life happens every day. When life happens, plans change. When plans change, you realize that you need some extra money.

When you discover that you need money, make your life easier and talk to us!

Through the Personal Accomplishments Loan, you benefit of:

Up to 200.000 lei

Payable in 12 to 60 months

With an Annual Fixed Interest Rate from 5,99% to 19,99%

Personal Accomplishments Loan

This product is offered by UniCredit Consumer Financing IFN S.A. through UniCredit Bank S.A., credit intermediary exclusively for loans granted by UniCredit Consumer Financing IFN S.A.

Interest rates

Our offer of discounted interest rates considering that the income cashing condition is fulfilled1

| PERSONAL ACCOMPLISHMENTS LOANS WITHOUT MORTGAGE FULFILLING THE INCOME CASHING CONDITION1 | Fixed interest rate / year | Fixed interest rate / year for clients that refinance an external loan or acquire a UniCreditCard credit card 3 | |

| 170.000 - 200.000 LEI | Without insurance |

9,99% | 7,99% |

| With life insurance2 | 7,99% | 5,99% | |

| 140.000 - 169.999 LEI | Without insurance | 10,49% | 8,49% |

| With life insurance2 | 8,49% | 6,49% | |

| 110.000 - 139.999 LEI |

Without insurance | 10,99% |

8,99% |

| With life insurance2 | 8,99% |

6,99% | |

| 80.000 - 109.999 LEI | Without insurance | 12,99% | 10,99% |

| With life insurance2 | 10,99% | 8,99% | |

| 50.000 - 79.999 LEI |

Without insurance | 14,99% |

12,99% |

| With life insurance2 | 12,99% |

10,99% | |

| 1.500 - 49.999 LEI | Without insurance | 17,99% | 15,99% |

| With life insurance2 | 15,99% | 13,99% | |

1The discount of 2 percentage points applied to the annual interest rate (compared to the interest applied to a loan product without income transfer) will be applied under the conditions and situations stipulated in the credit contract, in the context of the fulfillment of the monthly cashing condition, representing the obligation of ensuring during the entire duration of the credit agreement of a total monthly cashing amount in the current accounts opened at UniCredit Bank of the Borrower (person who signed the credit application as an Applicant), in the amount of at least 70% of the income taken into account for granting the credit, respectively for the subsequent granting of another loan (Monthly Cashing Condition).

2Life insurance with monthly premium of 0.12% applied to the borrowed amount.

3The price offer assumes the refinancing on a period of up to 5 years of a loan offered by another credit institution/ non-banking financial institution from Romania or their branches from Romania or the acquisition of a UniCreditCard Premium or Principal credit card issued by UniCredit Consumer Financing.

The credit card and insurance products are optional; the client can apply for a loan product without buying also a credit card or life insurance, in different cost conditions.

Find out more about the conditions of the 2 percentage points discount on the interest rate, applied during the fulfillment of the Income Cashing Condition:

Representative example in the assumption of the application of the discounted annual interest rate for the entire duration of the loan, in the context of fulfillment of the monthly cashing condition: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through UniCredit Bank S.A. (credit intermediary with exclusive auxiliary title of the loans offered by UniCredit Consumer Financing IFN SA), in value of 170.000 Lei, for 60 months:

Interest rate |

Life insurance |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

7,99% |

Without insurance |

420 lei |

0 lei |

10 lei |

3.475,21 Lei |

208,512.47 Lei |

8,80% |

5,99% |

With life insurance with monthly premium |

420 lei |

0 lei |

10 lei |

3.512,56 Lei (monthly rate includes life insurance cost4) |

210.753,71 Lei |

9,30% |

The exemplified interest offer of 5,99% involves: (i) the fulfillment throughout the credit period of the Monthly Cashing Condition, (ii) refinancing a loan offered by another credit institution/ non-banking financial institution from Romania or their branches from Romania or the acquisition of a UniCreditCard Premium or Principal credit card issued by UniCredit Consumer Financing, (iii) the attachment of a life insurance and (iv) a total credit amount between 170.000 and 200.000 Lei.

Our interest rates offer, in the context of not fulfilling the income cashing condition:

| PERSONAL ACCOMPLISHMENTS LOANS WITHOUT MORTGAGE | Fixed interest rate / year | Fixed interest rate / year for clients that refinance an external loan or acquire UniCreditCard credit card6 | |

| 170.000 - 200.000 LEI | Without insurance |

11,99% | 9,99% |

| With life insurance5 | 9,99% |

7,99% | |

| 140.000 - 169.999 LEI | Without insurance | 12,49% | 10,49% |

| With life insurance5 | 10,49% | 8,49% | |

| 110.000 - 139.999 LEI |

Without insurance | 12,99% |

10,99% |

| With life insurance5 | 10,99% |

8,99% | |

| 80.000 - 109.999 LEI | Without insurance | 14,99% | 12,99% |

| With life insurance5 | 12,99% | 10,99% | |

| 50.000 - 79.999 LEI |

Without insurance | 16,99% |

14,99% |

| With life insurance5 | 14,99% |

12,99% | |

| 1.500 - 39.999 LEI | Without insurance | 19,99% | 17,99% |

| With life insurance5 | 17,99% | 15,99% | |

5Life insurance with monthly premium of 0.12% applied to the borrowed amount.

6The price offer assumes refinancing on a period of up to 5 years of a loan offered by another credit institution/ non-banking financial institution from Romania or their branches from Romania or the acquisition of a UniCreditCard Premium or Principal credit card issued by UniCredit Consumer Financing.

The credit card and insurance products are optional; the client can apply for a loan product without buying also a credit card or life insurance, in different cost conditions.

Representative example in the assumption of the application of the annual interest rate applied on the entire duration of the contract, considering the fulfillment of the monthly cashing condition is not met and the discount related to the condition not applied: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through UniCredit Bank S.A. (credit intermediary with the exclusive auxiliary title of the credits offered by UniCredit Consumer Financing IFN SA), in the amount of 170.000 Lei, for 60 months:

Interest rate |

Life insurance |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

9,99% |

Without insurance |

420 lei |

0 lei |

10 lei |

3.646,98 Lei |

219.819 Lei |

11,06% |

7,99% |

With life insurance with monthly premium |

420 lei |

0 lei |

10 lei |

3.679,21 Lei (monthly rate includes life insurance cost6) |

220.752,47 Lei |

11,48% |

The exemplified interest offer of 8,19% involves: (i) refinancing a loan offered by another credit institution or a financial non-banking institution or branches from Romania of such foreign institutions or the acquisition of a UniCreditCard Premium or Principal credit card issued by UniCredit Consumer Financing and (ii) the attachment of a life insurance and (iii) a total credit amount between 170.000 and 200.000 Lei and (iv) non-fullfillment of the Income Cashing Condition on the entire duration of the contract.

EAR is calculated according to the legal regulation in force and includes annual fixed interest rate, file analysis fee (420 Lei), monthly credit administration fee (0 Lei), Monthly administration fee for the current account opened at UniCredit Bank SA (10 Lei) and, in the case the client acquires a life insurance, the cost of the insurance premium.

We inform you that, in the case of repayment in equal monthly installments, the total amount of interest is higher than in the case of repayment in decreasing installments. Depending on the duration of the loan, the value of the monthly principal rate, at the beginning, may be lower than the monthly interest rate, and the loan balance decreases more slowly. You can make partial or full early repayments at any time.

Details regarding the life insurance attached to the loan and its costs, considering the representative examples presented above:

Insurance premium |

Life insurance with monthly premium |

Means of payment: |

It is paid deferred (monthly) from the clients own sources, being included in the monthly installments. |

Calculation method: |

0,12% x 170.000 Lei (value of the loan) |

Value of the insurance premium: |

204 Lei / month |

Financing cost of the life insurance premium: |

4 0 Lei / 7 0 Lei

|

The benefits of the insurance attached to the loan |

The insurance product offers protection in the case of impossibility of debt payment to the Lender. The following events that can lead to payment incapacity are covered by the insurance:

You may find more details regarding the insurance benefits on www.ucfin.ro/asigurari. |

Calculation example: For UniCreditCard Principal without life insurance attached/ with life insurance attached (with monthly premium of 0,5% from the borrowed amount, offered by UniCredit Consumer Financing IFN SA), with a limit of 5.367 lei, lending period of 3 years (36 months) and a fixed annual interest of 26,99% for ATM usage and 24,99% for transactions at retailers, considering that the credit line is fully withdrawn, 40% cash at ATM national or international (outside of UniCredit Group) and 60% transactions at retailers, upon approval date and no further transactions are made during the 36 months’ reimbursement period, the monthly amount due (considering equal monthly installments) is 313,71 Lei / 340,13 Lei, total payable amount is 7.630,18 Lei / 8.139,1 Lei, with EAR of 31,33% / 39,2%. EAR is calculated according to legal regulations in force and is comprised of the fixed annual interest, the issuance commission and the annual administration commission of 39 lei, the ATM (network of other banks in Romania and from abroad) usage fee of 2% + 4 lei, and, in case the client chooses to acquire a life insurance, the monthly premium of life insurance of 0,5% from the borrowed amount (in the amount of 26,4 lei/month, with zero costs of financing for insurance).

Calculation example: For UniCreditCard Premium without life insurance attached/ with life insurance attached (with monthly premium of 0,5% from the borrowed amount), offered by UniCredit Consumer Financing IFN SA), with a limit of 5.367 lei, lending period of 3 years (36 months) and a fixed annual interest of 26,99% for ATM usage and 24,99% for transactions at retailers, considering that the credit line is fully withdrawn, 40% cash at ATM national or international (outside of UniCredit Group) and 60% transactions at retailers, upon approval date and no further transactions are made during the 36 months’ reimbursement period, the monthly amount due (considering equal monthly installments) is 458,75 Lei / 484,36 Lei, total payable amount is 7.887,45 Lei / 8.380,94 Lei, with EAR of 39,27%/47,61%. EAR is calculated according to legal regulations in force and is comprised of the fixed annual interest, the annual administration commission of 200 lei, the ATM (network of other banks in Romania and from abroad) usage fee of 2% + 4 lei, and, in case the client chooses to acquire a life insurance, the monthly premium of life insurance of 0,5% from the borrowed amount (in the amount of 25,61 lei/month, with zero costs of financing for insurance).

In case you want to attach to the credit product a life insurance product, we kindly ask you to consult the details and related costs on www.ucfin.ro/asigurari. Life insurance is issued by Generali Romania Asigurare Reasigurare S.A. through UniCredit Consumer Financing IFN SA, as an auxiliary insurance agent registered with the Financial Supervisory Authority with the number RAJ-502078 and is an optional product, the credit product being available for granting without a life insurance attached.

These products are offered by UniCredit Consumer Financing IFN SA through UniCredit Bank SA, credit intermediary with the exclusive auxiliary title of the credits offered by UniCredit Consumer Financing IFN SA. The decision for crediting belongs solely to UniCredit Consumer Financing IFN SA, the Creditor reserving the right to request, when the case, any documents necessary in the crediting analysis, according to its internal regulations and the legal effective settlements.

In order for the loan to be granted, the client must sign a current account contract with UniCredit Bank (“the Bank”), if he/she does do not already have a current account opened at the Bank. The costs of the current account are paid by the client and are charged separately by the Bank and are the ones included in the Individual’s fee and Interest Rates list available on www.unicredit.ro. Opening a current account can be done through a variety of available financial products or services. As the choice of the current account services package is exclusively the responsibility of the Client, the product or service is not in the Creditor's offer, the costs for the operations or services related to the current account depend on the chosen product or services and are not known to the creditor, for the representative example and the DAE calculation hypothesis presented, it was taken into consideration the current account administration fee, which is part of the standard offer for the current account payment services and transactions offered by the Bank, in the amount of 10 Lei/month. All costs related to UniCredit Bank SA products and services, such as opening fees, account administration, operations related to the account if / or services related to the account are due by the customer to UniCredit Bank SA if they will be charged separately by him according to the signed documents between the client and UniCredit Bank SA.

After granting the loan, at any time during the contract, the Client may request the closure of the current account opened at the Bank, following which the repayment of the loan should be made by the Client to the account indicated by the Creditor. In this situation, if the Client has benefited from a reduction in the annual interest rate for fulfilling the cashing condition in the current accounts opened by the Client at the Bank (Monthly Cashing Condition), it must be taken into account that, once closing the account and ceasing the transfer of income, the annual interest rate will be applied without the discount granted starting with the first due date after the date on which the Client unilaterally terminates the current account contract concluded with the Bank.

The full repayment of the refinanced / refinanced loan (s) will be made by order / documentary payment order (documented / conditioned), in the account related to the refinanced loan opened with the bank / account of the financial institution that granted the refinancing loan. The cost related to the documentary payment order (conditional) is of 15 EUR, for the orders processed until 31.12.2024 and is supported by the Client and charged by UniCredit Bank SA; the cost available after this date is the one displayed in the List of Fees and Interest rates for Private Individuals that can be found here. The fees and charges of the bank whose loan is refinanced / the non-banking financial institution whose loan is refinanced or in connection with the documentary payment order (conditional) are borne by the Borrower and will be paid from his account opened with the respective bank / will be paid at the counters of the respective bank.

The present does not value, according to the law, the offer to contract financial products / services from UniCredit Consumer Financing IFN S.A., which can be modified or revoked at any time. According to the law, the product or financial service offer is the one valid at the time of registration of the product / service request and, regardless of the elements of the respective offer, the contract is considered concluded only on the date of its formal signature or, as the case may be, according to the legal provisions applicable to the remote contract conclusion.

Commissions

| Commission name |

LEI Credit |

| Loan administration commission |

0 LEI |

| File analysis commission | 420 LEI, deferred in monthly payments during the lifetime of the loan (charged only in case of granting the credit) |

| Anticipated Reimbursement commission | 1% for the fixed rate interest period 0,5% for reimbursements made within less than a year before the final due date. |

| Non-payment penalties (for total payment overdues) | Interest rate (when the loan does not register outstanding) + 3% per year |

| Unique commission for services provided on customer demand | 180 LEI |

| Monthly administration fee for the current account opened at UniCredit Bank, levied by UniCredit Bank SA | 10 LEI |

| Documentary payment order (conditional) issuance fee, levied by UniCredit Bank SA | 15 EUR - for the orders processed until 31.12.2024 |

Necessary documents

![]()

Necessary documents needed for financial approval:

- Identity document (BI/CI);

- Documents that may attest income or ANAF Consulting Agreement.

(to be filled in UniCredit Bank branch);

*Useful for persons (employed or retired) for which there are legal obligation of declaring income to fiscal authorities.

- Credit Application

We reserve the right to request additional documents, in case needed, as implied by internal rules.

How do you sign electronically?

In order to be able to sign electronically you have to own a mobile phone number, an email address (where you will receive the full signed documentation) and to agree with the electronic signing.

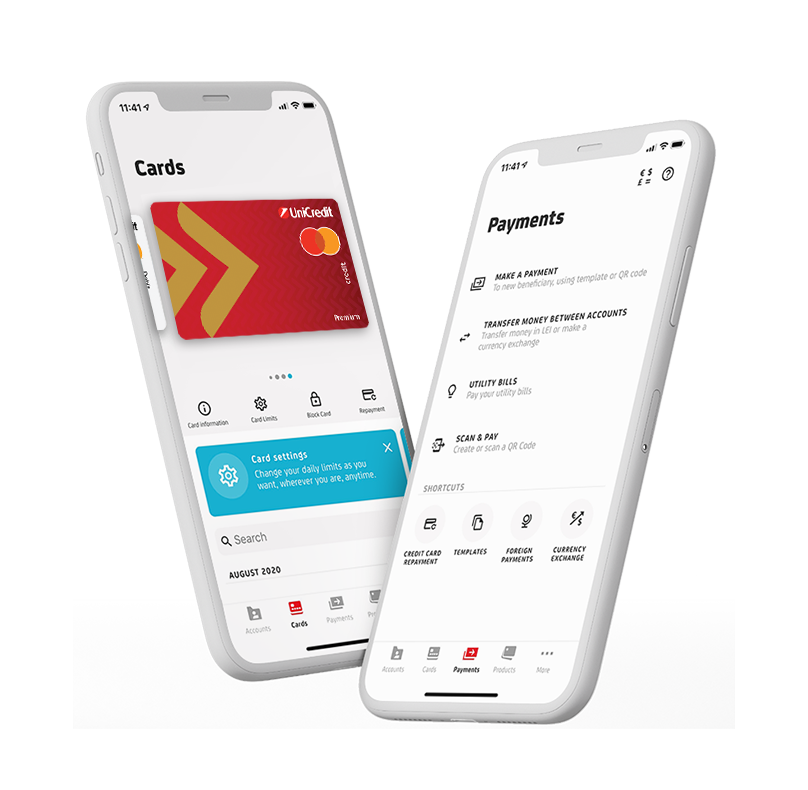

In order to sign using the Mobile Banking service from UniCredit Bank you have to own a valid phone number, to be a UniCredit Bank client and use the Mobile Banking app from UniCredit Bank (where you will receive the full signed documentation) and to agree with the electronic signing via Mobile Banking.

The electronic signature can be used after obtaining an electronic certificate from TRANS SPED SRL, trusted and qualified services provider. The certificate can be obtained at no cost in any UniCredit Bank SA agency/branch by the loan applicant that meets the conditions to electronically sign and can be use in relation with UniCredit Consumer Financing IFN S.A.

Eligibility conditions

![]()

In order to contractually obtain an Personal Loan without mortgage it is imperative to respect the next minimal conditions of eligibility:

- Minimum age: 22 years old ( 25 for sailors );

- Maximum age (the age by which the credit must be reimbursed in its entirety): 70 years old (60 years for sailors.);

- Monthly eligible minimum income:

- For retired persons (living on a pension): 1.281 Lei;

- For employees (incomes from salaries, excluding maternity leave indemnities): 1.898 Lei;

- For persons in Maternity Leave with incomes from dedicated indemnities: 1.314 Lei;

- For sailors: 1.250 Lei.

Insurance

You can attach an insurance package with diverse coverage, to your Unexpectedly Easy Credit, as shown below. However getting an insurance package is not mandatory in order to obtain the credit.

| Insurance type |

Formula | Coverage | Bonus percentage |

| Monthly bonus | Credit value x bonus percentage | Death, by any cause, total permanent disability, involuntary loss of job | 0,1% |