Loan

100% Mobile

Creditul de Realizari Personale

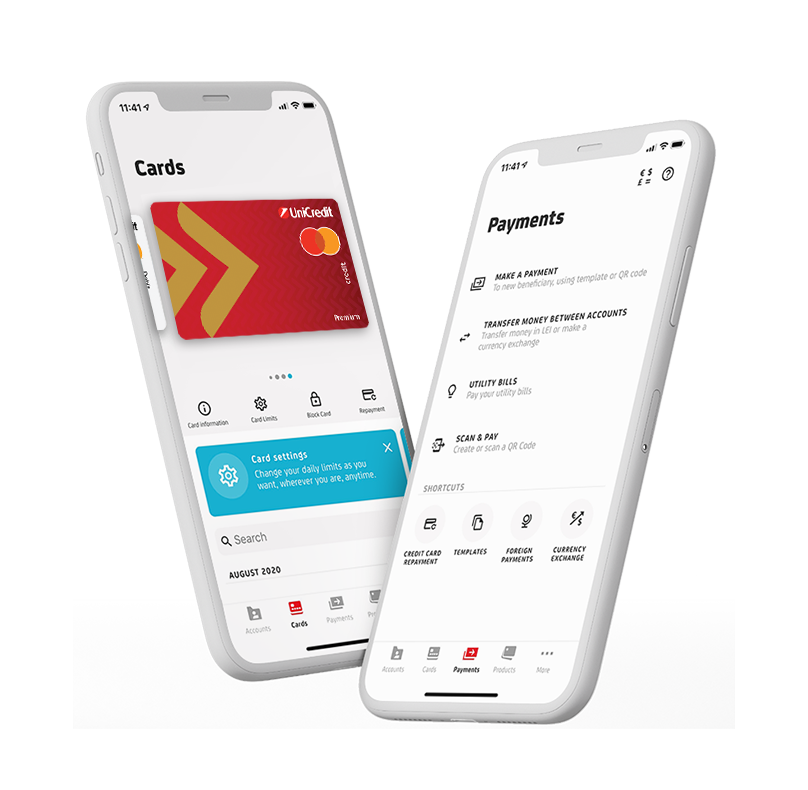

Now you can take the loan offered by UniCredit Consumer Financing easier, directly from your mobile phone, accessing the UniCredit Consumer Financing offer in the Mobile Banking app.

THE ADVANTAGES OF THE 100% MOBILE LOAN:

Directly from your mobile phone, by accessing the offer in the UniCredit Bank’s Mobile Banking app.

At any hour, from anywhere you are, without going in the branch.

With no printed papers, the whole process is digital and safe.

You can borrow up to 150.000 Lei

Payable in 12 to 60 months

With an Annual Fixed Interest Rate

ELIGIBILITY CONDITIONS:

It is necessary to:

✓ Own a current account in Lei opened at UniCredit Bank and have the Mobile Banking app activated.

✓ Be between 22 and 70 years old (the age by which the credit must be reimbursed in its entirety)

✓ Have registered income in the data base of the National Agency of Fiscal Administration (ANAF) and agree to this data base interrogation

✓ Have a minimum monthly income of: 1.814 Lei, if you are employed, or 1.281 Lei, if you are retired.

YOUR APPLICATION GUIDE FOR A PERSONAL ACCOMPLISHMENTS LOAN ACCESSED IN MOBILE BANKING:

Super easy. Get through the necessary steps in the app, in just a few minutes.

MAKE SURE YOU HAVE THE UPDATED VERSION OF THE MOBILE BANKING APP AND INITIALIZE THE PROCESS

Enter the Offer section and start the process for requesting a loan.

CHECK ON YOUR PERSONAL DATA

Validate your personal data, offered in relation with the Bank.

SIGN THE AGREEMENTS AND THE INFORMATION NOTES

Sign electronically the loan documentation and the one necessary to interrogate the data bases, like ANAF and Credit Bureau.

ANALYSE THE CREDIT OFFER

Taking into consideration the income registered in ANAF data base, we calculate and indicate to you the maximum amount that you can borrow.

SIGN THE CONTRACT

Sign the contract with qualified digital signature.

For more details, you can consult the application guide.

You can check up anytime the loan terms directly in the Mobile Banking app.

THE BENEFITS OF THE QUALIFIED ELECTRONIC SIGNATURE

The qualified electronic signature is available free of charge to all the persons that request a loan and have a valid e-mail address and mobile phone number, from Romania, the costs of the certificate being covered by UniCredit Consumer Financing I.F.N. S.A.

The qualified electronic signature certificate is issued by TRANS SPED SRL, trustful and qualified service provider. The qualified electronic signature has the same legal value as the holograph one (handwritten).

DO YOU HAVE QUESTIONS?

Call us at 021.200.86.12 (normal tariff in the fixed communication network Orange Romania Communications), available from Monday to Friday, between 09:00-17:30.

You can access the Personal Accomplishments Loan from Mobile Banking with interest rates starting from 6,99%, according to your options:

- You have a 2 percentage points discount, if you acquire a life insurance1 attached to the loan

- And an additional 2 percentage points discount, if you fulfill the income cashing condition2 in the current accounts opened at UniCredit Bank

If you opt for a Credit product with the fulfillment of the condition of monthly turnover2 of income, you benefit from the following interest offers:

| PERSONAL ACCOMPLISHMENTS LOAN WITHOUT MORTGAGE, 100% MOBILE | Fixed interest rate / year WITHOUT FULFILLING THE INCOME CASHING CONDITION | Fixed interest rate / year FULFILLING THE INCOME CASHING CONDITION2 | |

| 140.000 - 150.000 LEI | Without insurance |

10,99% | 8,99% |

| With life insurance1 | 8,99% | 6,99% | |

| 110.000 - 139.999 LEI | Without insurance |

11,99% | 9,99% |

| With life insurance1 | 9,99% | 7,99% | |

| 80.000 - 109.999 LEI | Without insurance |

13,99% | 11,99% |

| With life insurance1 | 11,99% | 9,99% | |

| 50.000 - 79.999 LEI | Without insurance |

16,99% | 14,99% |

| With life insurance1 | 14,99% | 12,99% | |

| 1.500 - 49.999 LEI | Without insurance |

19,49% | 17,49% |

| With life insurance1 | 17,49% | 15,49% | |

1 Life insurance is with monthly premium of 0.12% of the borrowed amount. The life insurance product is optional. You can apply for a credit product without acquiring a life insurance, with different pricing conditions.

2 The interest offer assumes the fulfillment of the income cashing condition in the amount of at least 500 Lei/month in the current accounts opened at UniCredit Bank SA for at least 2 months from the last 4 months previously to the credit application (the 4th month being the current month in which the credit is requested and the Annex to the Credit Application is signed) and the fulfillment throughout the credit period of the Monthly Cashing Condition. Maintaining the lower interest rate (compared to the interest applied to a credit product without cashing income) for the entire duration of the credit agreement is conditioned by the monthly cashing in your current accounts opened at UniCredit Bank SA, of total amounts of at least 70% of the income taken into consideration at the moment when the loan was granted, respectively for the subsequent granting of another loan (Monthly Cashing Condition).

Representative example: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through the Mobile Banking app from UniCredit Bank S.A. (the “Bank”), in amount of 15.000 Lei/ 150.000 Lei, for 60 months, in case you choose equal installments:

Loan value |

Fulfillment of the monthly income cashing condition2 |

Insurance1 |

Annual fixed interest rate |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

15.000 Lei |

X |

X |

19,49% |

420 Lei |

0 Lei |

10 Lei |

406,24 Lei |

24.374,26 Lei |

24,64% |

X |

✓ |

17,49% |

420 Lei |

0 Lei |

10 Lei |

406,98 Lei (monthly rate includes life insurance cost 4) |

24.419,14 Lei |

24,75% |

|

✓ |

X |

17,49% |

420 Lei |

0 Lei |

10 Lei |

388,98 Lei |

23.339,14 Lei |

22,17% |

|

✓ |

✓ |

15,49% |

420 Lei |

0 Lei |

10 Lei |

346,17Lei (monthly rate includes life insurance cost 4) |

23.409,81 Lei |

22,33% |

|

100.000 Lei |

X |

X |

10,99% |

420 Lei |

0 Lei |

10 Lei |

3.296,22 Lei |

197.773,17 Lei |

12,32% |

X |

✓ |

8,99% |

420 Lei |

0 Lei |

10 Lei |

3.322,40 Lei (monthly rate includes life insurance cost 5) |

199.344,14 Lei |

12,62% |

|

✓ |

X |

8,99% |

420 Lei |

0 Lei |

10 Lei |

3.142,40 Lei |

188.544,14 Lei |

9,96% |

|

✓ |

✓ |

6,99% |

420 Lei |

0 Lei |

10 Lei |

3.173,10 Lei (monthly rate includes life insurance cost 5) |

190.385,71 Lei |

10,41% |

Representative example: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through the Mobile Banking app from UniCredit Bank S.A. (the “Bank”), in amount of 15.000 Lei/ 150.000 Lei, for 60 months, in case you choose decreasing installments:

Loan value |

Fulfillment of the monthly income cashing condition2 |

Insurance1 |

Annual fixed interest rate |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

15.000 Lei |

X |

X |

19,49% |

420 Lei |

0 Lei |

10 Lei |

646,80 Lei |

22.996,72 Lei |

24,72% |

✓ |

X |

17,49% |

420 Lei |

0 Lei |

10 Lei |

653,95 Lei (monthly rate includes life insurance cost 4) |

23.328,42 Lei |

25,27% |

|

X |

✓ |

17,49% |

420 Lei |

0 Lei |

10 Lei |

635,95 Lei |

22.248,42 Lei |

22,37% |

|

✓ |

✓ |

15,49% |

420 Lei |

0 Lei |

10 Lei |

636,43 Lei (monthly rate includes life insurance cost 4) |

22.573,38 Lei |

22,92% |

|

150.000 Lei |

X |

X |

10,99% |

420 Lei |

0 Lei |

10 Lei |

5.208,71 Lei |

193.647,36 Lei |

12,29% |

✓ |

X |

8,99% |

420 Lei |

0 Lei |

10 Lei |

4.897,04 Lei (monthly rate includes life insurance cost 5) |

196.580,69 Lei |

12,86% |

|

X |

✓ |

8,99% |

420 Lei |

0 Lei |

10 Lei |

4.717,04 Lei |

185.780,69 Lei |

10,00% |

|

✓ |

✓ |

6,99% |

420 Lei |

0 Lei |

10 Lei |

4.405,38 Lei (monthly rate includes life insurance cost 5) |

188.714,08 Lei |

10,60% |

The exemplified interest offer of 15,49/ 6,99% year involves: (i) fulfillment of the income cashing condition in the amount of at least 500 Lei/month in the current accounts opened at UniCredit Bank SA for at least 2 months from the last 4 months previously to the credit application (the 4th month being the current month in which the credit is requested and the Annex to the Credit Application is signed) and (ii) the fulfillment throughout the credit of the Monthly Cashing Condition and (iii) the attachment of a life insurance.

We inform you that, in the case of reimbursement in equal monthly installments, the total interest amount is higher than in the case of repayment in decreasing installments. Depending on the loan period, the value of the monthly principal rate, at the beginning, may be lower than the monthly interest rate value, and the balance credit to decrease more slowly. Partial or full early repayments can be made at any time.

In case you do not opt for a Credit product with the fulfillment of the condition of monthly turnover of income, you benefit from the following interest offers:

| PERSONAL ACCOMPLISHMENTS LOAN WITHOUT MORTGAGE, 100% MOBILE | Fixed interest rate / year WITHOUT FULFILLING THE INCOME CASHING CONDITION | Fixed interest rate / year REFINANCE AN EXTERNAL LOAN3 | |

| 140.000 - 150.000 LEI | Without insurance |

10,99% | 8,99% |

| With life insurance1 | 8,99% | 6,99% | |

| 110.000 - 139.999 LEI | Without insurance |

13,99% | 11,99% |

| With life insurance1 | 11,99% | 9,99% | |

| 80.000 - 109.999 LEI | Without insurance |

15,99% | 13,99% |

| With life insurance1 | 13,99% | 11,99% | |

| 50.000 - 79.999 LEI | Without insurance |

18,99% | 16,99% |

| With life insurance1 | 16,99% | 14,99% | |

| 1.500 - 49.999 LEI | Without insurance |

21,49% | 19,49% |

| With life insurance1 | 19,49% | 17,49% | |

1 Life insurance is with monthly premium of 0.12% of the borrowed amount.

3 The interest offer involves the refinancing for a period of up to 5 years of a loan granted by another banking or non-banking financial institution in Romania or branches in Romania of such foreign institutions, which accept the Documentary Payment Order (Conditional) for full-anticipated reimbursement.

Representative example: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through the Mobile Banking app from UniCredit Bank S.A. (the “Bank”), in amount of 15.000 Lei/ 150.000 Lei, for 60 months, in case you choose equal installments:

Loan value |

Fulfillment of the monthly income cashing condition2 |

Insurance1 |

Annual fixed interest rate |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

15.000 Lei |

X |

X |

21,49% |

420 Lei |

0 Lei |

10 Lei |

423,92 Lei |

25.434,99 Lei |

27,17% |

✓ |

X |

19,49% |

420 Lei |

0 Lei |

10 Lei |

424,24 Lei (monthly rate includes life insurance cost) |

25.454,26 Lei |

27,21% |

|

X |

✓ |

19,49% |

420 Lei |

0 Lei |

10 Lei |

406,24 Lei |

24.374,26 Lei |

24,64% |

|

✓ |

✓ |

17,49% |

420 Lei |

0 Lei |

10 Lei |

406,98 Lei (monthly rate includes life insurance cost) |

24.419,14 Lei |

24,75% |

|

150.000 Lei |

X |

X |

12,99% |

420 Lei |

0 Lei |

10 Lei |

3.454,52 Lei |

207.270,84 Lei |

14,56% |

✓ |

X |

10,99% |

420 Lei |

0 Lei |

10 Lei |

3.476,22 Lei (monthly rate includes life insurance cost) |

208.573,17 Lei |

14,88% |

|

X |

✓ |

10,99% |

420 Lei |

0 Lei |

10 Lei |

3.296,22 Lei |

197.773,17 Lei |

12,23% |

|

✓ |

✓ |

8,99% |

420 Lei |

0 Lei |

10 Lei |

3.322,40 Lei (monthly rate includes life insurance cost) |

199.344,14 Lei |

12,62% |

Representative example: for a Personal Accomplishments Loan offered by UniCredit Consumer Financing IFN S.A. (as a result of meeting the eligibility criteria) through the Mobile Banking app from UniCredit Bank S.A. (the “Bank”), in amount of 15.000 Lei/ 150.000 Lei, for 60 months, in case you choose decreasing installments:

Loan value |

Fulfillment of the monthly income cashing condition2 |

Insurance1 |

Annual fixed interest rate |

File analysis fee (deferred in monthly payments during the lifetime of the loan, charged only in case the credit is granted) |

Monthly credit administration fee |

Monthly administration fee for the current account opened at UniCredit Bank SA |

Monthly equal rates |

Total payable value |

EAR |

15.000 Lei |

X |

X |

21,49% |

420 Lei |

0 Lei |

10 Lei |

668,89 Lei |

23.756,34 Lei |

27,16% |

✓ |

X |

19,49% |

420 Lei |

0 Lei |

10 Lei |

664,80 Lei (monthly rate includes life insurance cost) |

24.076,872 Lei |

27,63% |

|

X |

✓ |

19,49% |

420 Lei |

0 Lei |

10 Lei |

646,80 Lei |

22.996,72 Lei |

24,72% |

|

✓ |

✓ |

17,49% |

420 Lei |

0 Lei |

10 Lei |

653,95 Lei (monthly rate includes life insurance cost) |

23.328,42 Lei |

25,27% |

|

150.000 Lei |

X |

X |

12,99% |

420 Lei |

0 Lei |

10 Lei |

5.700,38 Lei |

201.514,08 Lei |

14,64% |

✓ |

X |

10,99% |

420 Lei |

0 Lei |

10 Lei |

5.338,71 Lei (monthly rate includes life insurance cost) |

204.447,36 Lei |

15,17% |

|

X |

✓ |

10,99% |

420 Lei |

0 Lei |

10 Lei |

5.208,71 Lei |

193.647,36 Lei |

12,29% |

|

✓ |

✓ |

8,99% |

420 Lei |

0 Lei |

10 Lei |

4.897,04 Lei (monthly rate includes life insurance cost) |

196.580,69 Lei |

12,86% |

The exemplified interest offer of 17,49/ 8,99% year involves: (i) the attachment of a life insurance and (ii) refinancing of a loan granted by another banking or non-banking financial institution in Romania or branches in Romania of such foreign institutions, which accept the Documentary Payment Order (Conditional) for full-anticipated reimbursement.

We inform you that, in the case of reimbursement in equal monthly installments, the total interest amount is higher than in the case of repayment in decreasing installments. Depending on the loan period, the value of the monthly principal rate, at the beginning, may be lower than the monthly interest rate value, and the balance credit to decrease more slowly. Partial or full early repayments can be made at any time.

EAR is calculated according to the legal regulation in force and includes annual fixed interest rate, file analysis fee (420 Lei), monthly credit administration fee (0 Lei), Monthly administration fee for the current account opened at UniCredit Bank SA (10 Lei) and, in the case the client acquires a life insurance, the cost of the insurance premium.

Details regarding the life insurance attached to the loan and its costs, considering the representative examples presented above:

Insurance Premium |

Life insurance with monthly premium |

Means of Payment |

It is paid deferred (monthly) from the clients own sources, being included in the monthly installments. |

Calculation method |

0,12% x 15.000 / 150.000 Lei (loan value) |

Value of the insurance premium (per month) |

318 Lei/ 5180 Lei |

Financing cost of the life insurance premium |

0 Lei |

The benefits of the insurance attached to the loan |

The insurance product offers protection in the case of impossibility of debt payment to the Lender. The following events that can lead to payment incapacity are covered by the insurance:

You may find more details regarding the insurance benefits on www.ucfin.ro/asigurari. |

In case you want to attach to the credit product a life insurance product, we kindly ask you to consult the details and related costs on www.ucfin.ro/asigurari. Life insurance is issued by Generali Romania Asigurare Reasigurare S.A. through UniCredit Consumer Financing IFN SA, as an auxiliary insurance agent registered with the Financial Supervisory Authority with the number RAJ-502078 and is an optional product, the credit product being available for granting without a life insurance attached.

The Personal Achievements Loan is a product offered by UniCredit Consumer Financing IFN SA and can be accessed from Mobile Banking, application offered by UniCredit Bank SA. The decision for crediting belongs solely to UniCredit Consumer Financing IFN SA, the Creditor reserving the right to request, when the case, any documents necessary in the crediting analysis, according to its internal regulations and the legal effective settlements.

In order for the loan to be granted, the client must sign a current account contract with UniCredit Bank (“the Bank”), if he/she does do not already have a current account opened at the Bank. The costs of the current account are paid by the client and are charged separately by the Bank and are the ones included in the Individual’s fee and Interest Rates list available on www.unicredit.ro. Opening a current account can be done through a variety of available financial products or services. As the choice of the current account services package is exclusively the responsibility of the Client, the product or service is not in the Creditor's offer, the costs for the operations or services related to the current account depend on the chosen product or services and are not known to the creditor, for the representative example and the DAE calculation hypothesis presented, it was taken into consideration the current account administration fee, which is part of the standard offer for the current account payment services and transactions offered by the Bank, in the amount of 10 Lei/month. All costs related to UniCredit Bank SA products and services, such as opening fees, account administration, operations related to the account if / or services related to the account are due by the customer to UniCredit Bank SA if they will be charged separately by him according to the signed documents between the client and UniCredit Bank SA.

After granting the loan, at any time during the contract, the Client may request the closure of the current account opened at the Bank, following which the repayment of the loan should be made by the Client to the account indicated by the Creditor. In this situation, if the Client has benefited from a discount of the annual interest rate for the monthly payment of income in the current accounts opened by the Client at the Bank (Monthly Cashing Condition), it must be taken into account that, once closing the account and ceasing the transfer of income, the annual interest rate will be applied without the discount granted, starting with the first due date after the date on which the Client unilaterally terminates the current account contract concluded with the Bank.

In case the client refinances on a period of up to 5 years a loan offered by another credit institution/ non-banking financial institution from Romania or their branches from Romania.

The full repayment of the refinanced / refinanced loan (s) will be made by order / documentary payment order (documented / conditioned), in the account related to the refinanced loan opened with the bank / account of the financial institution that granted the refinancing loan. The cost related to the documentary payment order (conditional) is of 15 EUR, for the orders issued until 31.12.2024 and is supported by the Client and charged by UniCredit Bank SA; the cost available after this date is the one displayed in the List of Fees and Interest rates for Private Individuals that can be found here. The fees and charges of the bank whose loan is refinanced / the non-banking financial institution whose loan is refinanced or in connection with the documentary payment order (conditional) are borne by the Borrower and will be paid from his account opened with the respective bank / will be paid at the counters of the respective bank.

The present does not value, according to the law, the offer to contract financial products / services from UniCredit Consumer Financing IFN S.A., which can be modified or revoked at any time. According to the law, the product or financial service offer is the one valid at the time of registration of the product / service request and, regardless of the elements of the respective offer, the contract is considered concluded only on the date of its formal signature or, as the case may be, according to the legal provisions applicable to the remote contract conclusion.

Interest

| Name of interest |

Loan in RON |

| Non-payment penalty (on outstanding principal) |

Interest rate (when the loan does not register outstanding) + 3% per year |

| Non-payment penalty (on outstanding principal) | Interest rate (when the loan does not register outstanding*) + 2% per year |

*If the client or his/her spouse is in one of the following situations: unemployment, experiencing a drastic reduction of salary, extended sick leave, divorce, death. "Drastic salary reduction" means a reduction of at least 15% of the salary amount.

Commissions

| Commission name |

LEI Credit |

| Loan administration commission |

0 LEI |

| File analysis commission | 420 LEI |

| Anticipated Reimbursement commission | 1% for the fixed rate interest period 0,5% for reimbursements made within less than a year before the final due date. |

| Unique commission for services provided on customer demand | 180 LEI |

| Monthly administration fee for the current account opened at UniCredit Bank | 10 LEI |

| Documentary payment order (conditional) issuance fee, levied by UniCredit Bank SA | 15 EUR - for the orders processed until 31.12.2024 |

The main advantages/disadvantages/risks associated with the legal methods of repayment of Personal Achievement Loans:

Constant annuity (equal installments/rates):

- the monthly rate consists of an increasing principal component and a decreasing interest component;

- the increase of the reference index used for interest calculation can lead to the increase of the annuity, to the increase of the interest component and to the decrease of the principal component;

- in the first part of the loan period, the monthly principal rate to be repaid is lower, compared to the other repayment option, the principal component of the total monthly rate being lower than the interest;

- the value of the personal loan that the applicant can take is higher;

- the pace of reduction/decrease of the credit balance is low;

- the total interest paid is higher than in the case of decreasing rates.

Equal principal (decreasing installments/rates):

- the monthly rate of the personal loan is composed of equal principal (for the entire duration of the loan) and decreasing interest;

- the increase of the reference index used for interest calculation can lead to the increase of the total monthly rate and the interest component, without changing the principal component;

- in the first part of the loan, the monthly rate to be repaid is higher;

- the loan amount the applicant can take is lower;

- the pace of reduction/decrease of the credit balance is higher;

- the total interest paid is lower than in the case of equal rates;

- in both cases, the monthly interest due is the result of applying the interest rate to the loan balance (the amount representing capital remaining to be repaid).

In ambele cazuri dobanda lunara datorata este rezultatul aplicarii ratei dobanzii la soldul creditului (suma reprezentand capital ramas de rambursat).