Current account transactional offers

Current account transactional offers

New transactional offers for a better today!

Changes, challenges, different needs! Regardless of the circumstances, we are here for you with a diverse range of transactional offers including bank accounts, each offer with benefits tailored to your needs.

Explore now the new current account offers and choose the right option for you. Discover the advantages of bank accounts that suit your financial situation and your aspirations. Opt for the right offer for you and enjoy the included benefits. See each offer below, including the conditions you must meet.

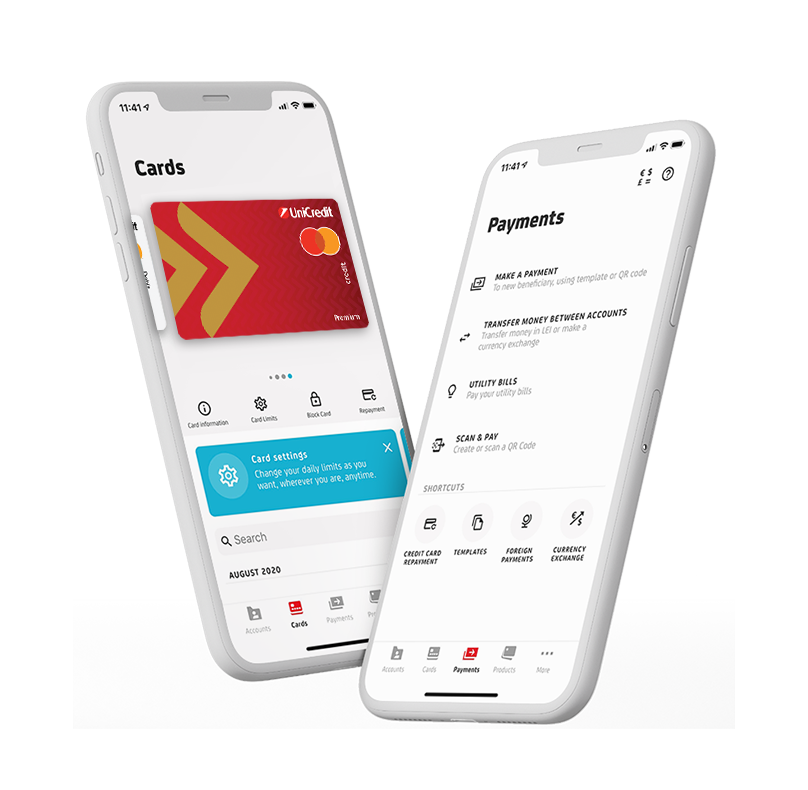

100% online current account directly from Mobile Banking!

Now it's even easier to open your first bank account at UniCredit Bank. Download the Mobile Banking app and have a whole new world of banking services at your fingertips.

Transactional offers from UniCredit Bank

OPTIM transactional offer

Which is the most suitable bank account offer for you? Explore the benefits of the OPTIM offer, it might be exactly what you are looking for.

Discover all the included advantages.

STAR transactional offer

Be the star of your banking! With the new STAR transactional offer you have multiple banking services included and more flexibility.

Discover all the included advantages.

PENSIONER transactional offer

With a current account, it's even easier to cash your pension on your card, or to offer a virtual gift to your grandchildren, or even to shop online. You have all the possibilities at your fingertips, with the Pensioner offer.

Discover all the included advantages.

YOUNG transactional offer

Maybe it's your first bank account where you're about to receive your first salary, or maybe you're doing well in school and you're about to receive a scholarship. Whatever you need, UniCredit Bank has an offer tailored to your needs.

Discover all the included advantages.

PREMIUM transactional offer

For a new banking experience, choose the PREMIUM current account offer. You have access to lots of benefits, through the range of transactions, services and products included in the offer.

Discover all the included advantages.

Payment account with basic features

Payment account with basic features – financially vulnerable customer

The Payment account with basic features is a bank account available in LEI for individuals who:

✔ are legally residents of the European Union (regardless of the consumer's place of residence), including people without a stable address, asylum seekers or people who have not been granted a residence permit and cannot be deported for factual and legally reasons;

✔ does not hold another payment account, including a Payment account with basic features, at any credit institution in Romania, or owns and declares that he has been notified of account closure;

✔ the monthly gross income in the form of salary, pension, allowance, social assistance allowance does not exceed the equivalent of 60% of the average gross salary gain for the economy, forecasted in the last macroeconomic forecast, respectively the autumn forecast, published by the National Forecasting Commission, respectively LEI 5.172 at the present date (for instance, if you collect salary income, for a gross income of LEI 5.172, the net income is LEI 3.060).

The Payment account with basic features can be requested by completing an account opening application in any UniCredit Bank branch, based on a valid identity document. Access to a Payment account with basic features or its use is not limited by the purchase of additional products and services, for example overdraft, credit card, etc., and is not conditioned by this.

Operations, products and services included:

- Lei account opening/maintaining/closing;

- Providing a debit card– issuing/maintenance a phisycal Mastercard Standard debit card and up to 5 Mastercard Standard virtual debit cards;

- Cash deposits at UniCredit Bank counter and at the Multifunctional devices (BNA) as well as cash withdrawals at UniCredit Bank counters and the counters of other banks through POS devices;

- Intrabank and interbank incomings;

- Cash withdrawals in LEI at ATM/BNA performed at the Bank’s network, Euronet network, other’s banks network in Romania, as well at UniCredit Group and other’s banks network from abroad;

- POS/internet transactions, national/internationa, including at gambling merchants;

- Intrabank and interbank Direct Debit in Lei;

- Credit transfer– intrabank and interbank payments in Lei and foreign currency at UniCredit Bank counters, via Online B@nking/Mobile B@nking (including through Standing Order and payments initiated via Payment service providers);

- Balance inquiry at Bank’s ATM, Euronet network, other’s banks network in Romania as well as at UniCredit Group and other’s banks network from abroad.

You can read more about the legal conditions, benefits and eligibility criteria aplicable for Payment account with basic features – financially vulnerable customer here and here.

Payment account with basic features – financially non - vulnerable customer

The Payment account with basic features is a bank account available in LEI for individuals who:

✔ are legally residents of the European Union (regardless of the consumer's place of residence), including people without a stable address, asylum seekers or people who have not been granted a residence permit and cannot be deported for factual and legally reasons;

✔ does not hold another payment account, including a Payment account with basic features, at any credit institution in Romania, or owns and declares that he has been notified of account closure;

✔ receives a monthly income in the form of salary, pension, allowance, social assistance allowance, regardless the amount level.

The Payment account with basic features can be requested by completing an account opening application in any UniCredit Bank branch, based on a valid identity document. Access to a Payment account with basic features or its use is not limited by the purchase of additional products and services, for example overdraft, credit card, etc., and is not conditioned by this.

Operations, products and services included:

- Lei account opening/maintaining/closing;

- Providing a debit card– issuing/maintenance a phisycal Mastercard Standard debit card and up to 5 Mastercard Standard virtual debit cards;

- Cash deposits at the Multifunctional devices (BNA) as well as cash withdrawals at UniCredit Bank counters and the counters of other banks through POS devices;

- Intrabank incomings;

- Cash withdrawals in LEI at ATM/BNA performed at the Bank’s network, Euronet network as well at UniCredit Group from abroad;

- POS/internet transactions, national/international, others than gambling;

- Intrabank and interbank Direct Debit in Lei;

- Credit transfer– intrabank payments in Lei and foreign currency via Online B@nking/Mobile B@nking (including through Standing Order and payments initiated via Payment service providers);

- Balance inquiry at Bank’s ATM, Euronet network as well as at UniCredit Group from abroad.

You can read more about the benefits and eligibility criteria aplicable for Payment account with basic features – financially non-vulnerable customer here.

Account Switch Service

Do you want more benefits for your current account, but you think that moving to another bank would take too much time?

Through the Account Switch Service, you only need a single trip to your closest UniCredit Bank branch and we will handle the rest.

Account Switch Service benefits:

- You can transfer your payment services from any bank in Romania to UniCredit Bank, free of charge;

- It is quick and easy, you can get it done with a single trip by filling in the Authorization form at any of our branches;

- You choose a current account fit for your needs, with ZERO fee for cash withdrawals from any ATM in Romania. Furthermore, you can also convert currency at the exchange rate published by NBR, up to EUR 1,000 per day, between 13:15 and 14:15, and many other facilities that we invite you to discover;

- UniCredit Bank carries out all the operations required for the transfer, in collaboration with the bank that you’re moving from (“the previous bank”).

Our Account Switch Service enables the transfer of:

- The direct debit mandate for the payment of utility bills;

- Standing orders;

- Recurrent incoming payments (for instance, salaries, rents, pensions, social services);

- Any positive balance remaining in the old account.

Furthermore, besides the transfer of services, you can also request the closing of the current account opened with the previous bank, without other formalities.

For more details regarding the flow necessary for current account relations, please access the Guide for Account Switch Service.

*Online Banking - Internet banking service .