PREMIUM transactional offer

PREMIUM transactional offer

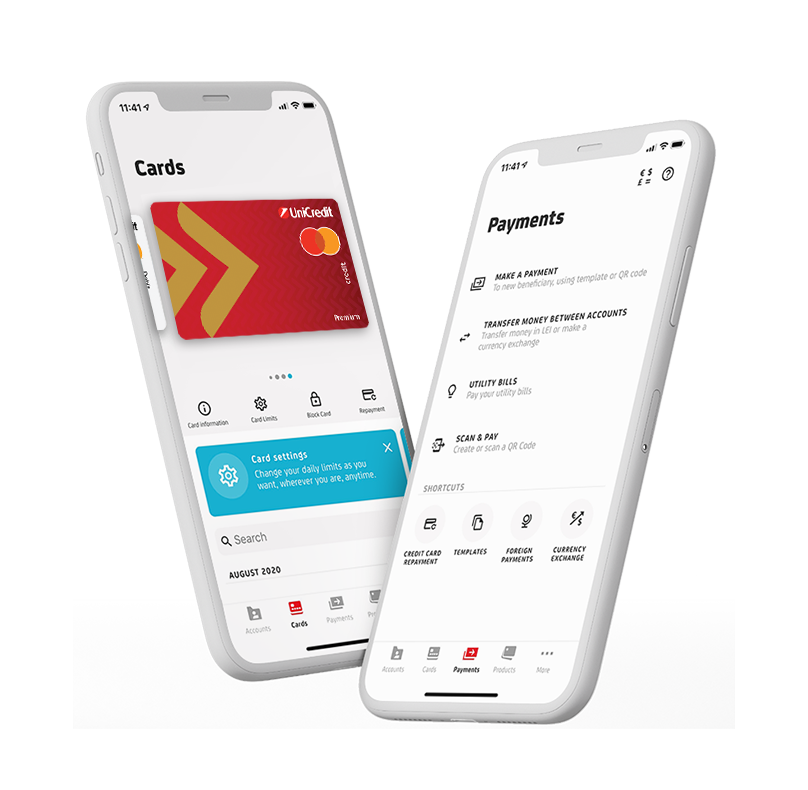

Discover our current account offer!

Today you want everything to be possible. And so it is!

Premium is a lifestyle. It is the next level where banking means many opportunities and exclusive experiences with the Premium bank account offer. Welcome!

The advantages of the PREMIUM offer

- Access to an extensive range of included operations and products.

- Exclusive benefits offered by insurance and services attached to Premium cards*.

- Access to consultants with expertise, who can guide you in choosing the investment products that suit your goals.

Be part of the UniCredit Bank universe, where opportunities meet your plans and the PREMIUM current account offer.

Premium debit cards (Mastercard Gold and Mastercard Platinum) are your passport to the next level, with included benefits* that meet your needs:

- Financial protection in the event of unforeseen events, accidents and/or illness (with Mastercard Platinum).

- Free travel insurance abroad (with Mastercard Gold and Mastercard Platinum).

- Access to VIP lounges in over 1200 locations of international airports, with the Priority Pass Card (for Mastercard Platinum card holders).

- Free access to the Mastercard Business Lounge at Otopeni, Timisoara, Sibiu, Cluj-Napoca and Vienna International Airports, twice a year (with Mastercard Gold).

- Mobile phone and smartwatch insurance. Details here. (with Mastercard Gold)

- Insurance of electronic and household appliances. Details here. (with Mastercard Gold)

- Online medical assistance Doctor Chat. Details here. (with Mastercard Gold)

Discover how you can benefit from all the advantages of the debit cards in our offer.

See the advantages of our debit cards.

*The benefits related to the card are independent of fulfilling the eligibility conditions of the offer. See all the advantages of Premium cards and choose the right one for you from our debit cards page.

** The commission for the provision (administration) of the first Mastercard Standard debit card is currently 0 (zero) without having to fulfill the eligibility conditions mentioned above, according to the Bank's standard offer.

*** Online Banking – Internet Banking service.

**** In the case of cash withdrawals abroad, the operators of the ATMs used may charge additional fees. Before authorizing the transaction, please, read carefully the messages displayed on the ATM screens, to make sure that you have taken note of the cash release conditions in such cases.