Current account

100% online

Woman in yellow shirt looking at phone in front of building

-

Your relationship with money is now fully digital

How to open an online current account at UniCredit Bank?

Now you have the opportunity to open your first current account at UniCredit Bank, 100% online, without having to go to the bank. All you need is to have Mobile Banking and follow the steps below.

2. Complete and validate your client contact information

3. Verify your identity

4. Provide personal and financial information

5. Sign the digital contract

When opening an online bank account in Lei and/or Euro at UniCredit Bank, you can also benefit from:

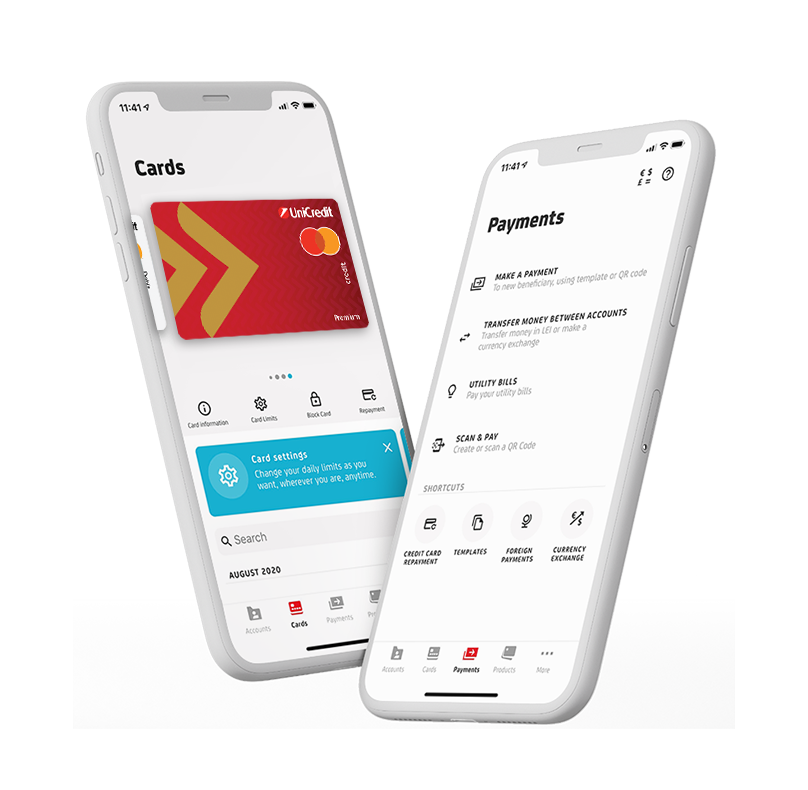

Access to financial products and services, through Mobile Banking

Current account in Lei and/or Euro, of your choice

Physical or virtual debit card attached to the account

Open an online bank account - 100% online - and benefit from advantageous price conditions, related to the Optim* transactional offer:

- ZERO* costs when managing a current account in RON and a current account in Euro.

- You have ZERO administration fee for the physical debit card.

- You have ZERO costs for credit transfer - interbank payments in RON to any bank in Romania, through Mobile Banking & Online Banking**.

- ZERO costs for interbank collections in RON and for payments by interbank direct debit in RON.

- ZERO costs for unlimited cash withdrawals in Lei at the bank’s ATMs and Euronet in Romania and in foreign currency at UniCredit Group network abroad, through the physical main and/or supplementary debit card included in the offer.

- ZERO costs for 4 transactions/month***** of cash withdrawals in Lei at other banks ATMs in Romania and in foreign currency at other banks ATMs abroad***, through the physical main and/or supplementary debit card included in the offer.

And if you have opened an online current account from Mobile Banking, don't forget that you can also benefit from other advantages, directly from the app:

- Add money - Easily and quickly transfer amounts to your online account from UniCredit Bank, using a debit card issued by any other bank, without commission

- Up to 5 free virtual Mastercard Standard cards, which you make and use on the spot, from the app. You can easily add them to your digital wallets (ApplePay and GooglePay) directly from Mobile Banking

- ShopSmart - buy with your UniCredit card and get part of the money back

- Save money with digital deposits

- Personal Financial Assistant in Mobile Banking – you get information about your history, trends and spending patterns

- 100% online credit card directly from Mobile Banking, through a 100% digital flow, offered by UniCredit Consumer Financing IFN SA

- 100% online personal loan directly from Mobile Banking, without trips to the bank, offered by UniCredit Consumer Financing IFN SA

- Happy hour Exchange Rate – for currency exchanges at the NBR exchange rate, every working day between 13:15 and 14:15****

- Withdraw cash without a card (Mcash) at any time, from UniCredit Bank ATMs and cash MFPs

* Eligibility conditions for the Optim transactional offer: you receive an income of at least 1,500 Lei (or equivalent in foreign currency) monthly in your current account or you have at least 50,000 Lei (or equivalent in foreign currency) in savings and investments and you make at least one monthly payment by physical or virtual debit card at merchants (POS or E-commerce). If for one month you do not cumulatively meet the eligibility conditions for any of the transactional offers, after the 10th of the following month you will be included on the bank's Standard Offer. Details/particularities regarding the transition from one offer to another or on standard conditions and exceptions to the need to meet certain eligibility conditions here.

** Online Banking – Internet Banking service.

***In the case of cash withdrawals abroad, the operators of the ATMs used may charge additional fees. Before authorizing the transaction, carefully read the messages that appear on the ATM screens, to make sure that you are aware of the cash release conditions in such cases.

**** The offer is subject to terms and conditions. More details in Benefit Programme Rules - "HAPPY HOUR EXCHANGE RATE″ - 2024, here.

***** Starting with the 5th cash withdrawal transaction made within the same month, with the main and/or supplementary debit card included in the offer, a commission of 1,5% min. 5 Lei/transaction will apply.