The virtual

debit card

Discover the latest banking product, 100% digital.

It’s time to make a change!

The most important resource in your life is time. It is what helps you share quality moments with your dear ones and offer them a better life.

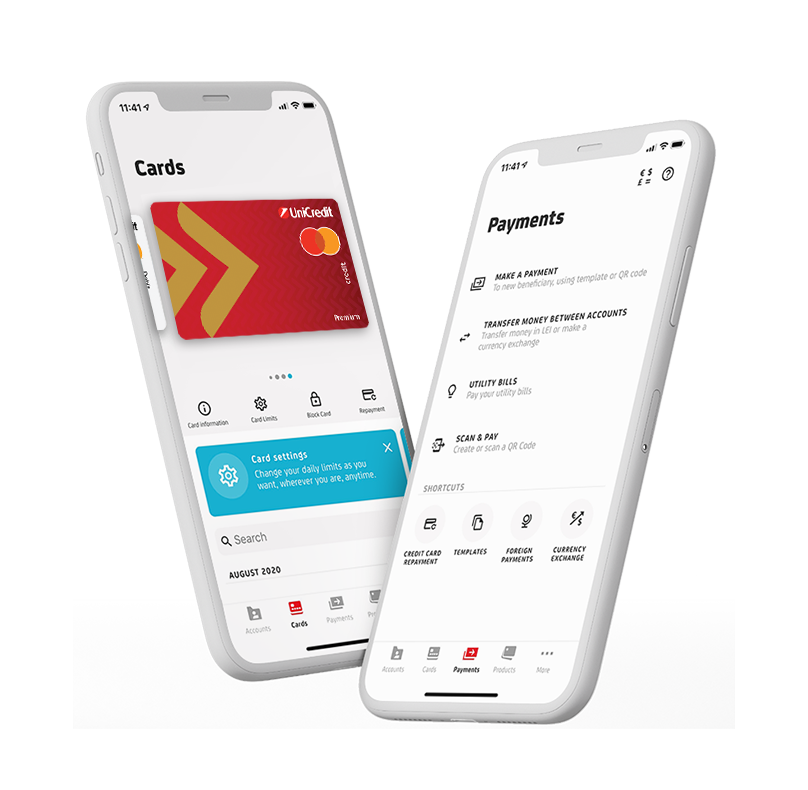

With the UniCredit Bank virtual debit card for individuals, everything Is about what matters to you. Like the moment you solve everything so quickly, directly from your smartphone and keep on enjoying the time with your family.

Choose the virtual debit card from UniCredit which can be attached to your current accounts in LEI or EUR and instantly issued in Mobile Banking. You will enjoy:

0 costs for issuing and renewing

100% online card administration through Mobile Banking, available 24/7

POS payments through Apple Pay and Google Pay, plus Internet transactions****

Characteristic and functionalities:

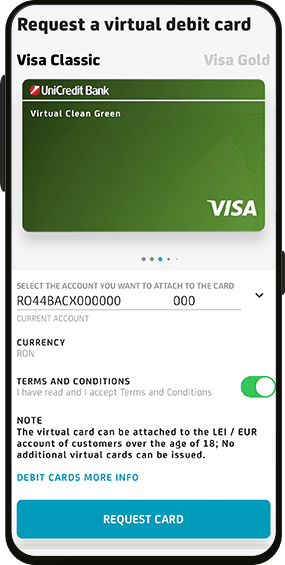

- The virtual debit cards are available for individuals, LEI or EUR account holders, over the age of 18;

- You can go for a Mastercard Standard virtual debit card or Mastercard Gold virtual debit card;

- You choose how your card looks like because there is a variety of colors available:

- 5 options for Mastercard Standard virtual cards: Pure Red, Electric Violet, Clean Green, Vibrant Orange or Jazzy Blue;

- 3 options for Mastercard Gold virtual cards: Warm Yellow, Light Beige or Jet Black;

- You are able to request up to 5 virtual cards attached to every account in LEI or EUR;

- The virtual cards are instantly issued and can be administered directly from Mobile Banking, available 24/7;

- There is no need to use a PIN code for the virtual card and transactions are approved as follows:

- POS transactions require the password you use for unblocking your mobile phone;

- Internet transactions require 3D secure authorization about which you can find more details HERE;

- The virtual card can not be used for ATM balance inquiry or cash withdrawal. For cash withdrawal without a physical card you have the following solutions:

- mCash at UniCredit Bank** ATMs**;

- Withdraw cash at POS (while performing a card payment transaction) at a merchant that uses an UniCredit Bank POS or one from another bank which allows the same service. Conditions of the Cash-Back at POS are available in “Useful Documents” section.

What should you do first?

Issue yourself a Mastercard Standard or Mastercard Gold virtual debit card, directly from Mobile Banking. To do it successfully, you need to make sure you have installed the last version of the app. You can update it right now:

And if you don’t have the Mobile Banking app, you can download and activate it right now, following this Mobile Banking tutorial.

For issuing a virtual debit card, follow the steps below and apply them directly in the Mobile Banking app:

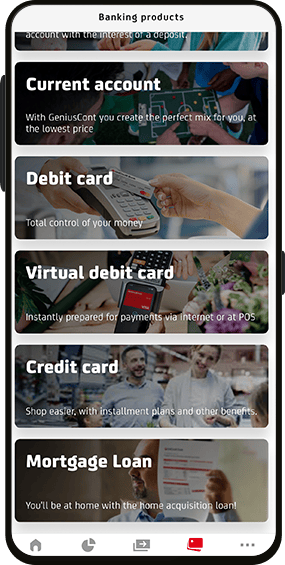

1. Log in, go to Offers menu and choose Virtual debit card

2. Select the related account, accept terms and conditions and request the card

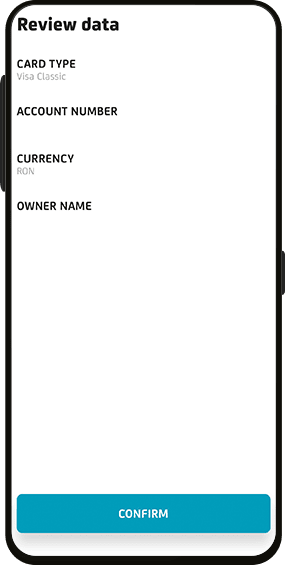

3. Verify and sign

Frequently asked questions

*The virtual debit card is issued for individual clients, LEI or EUR account holders. The product is not available for minors.

**The complete list of Charges and interests applied by the bank for individuals can be consulted in every bank branch and on www.unicredit.ro, Useful Documents section.

***It is necessary to activate the Mobile Banking app to use a virtual debit card from UniCredit Bank.

****The virtual card can not be used for cash withdraws or ATM balance inquiries.