Do you need funding

for the house of your dreams?

We’ll handle it! You just go find the right house and come get your Green Mortgage Loan!

We will advise you on the maximum amount that the bank can offer as a loan and we will be with you throughout the process. Below you can calculate the monthly rate with the amount and term you want.

Establish the parameters for the funding of your dream home

- A shorter time credit leads to a higher monthly rate, which in most cases burdens the monthly budget. We advise you to choose the monthly rate in such a way that it is sustainable even in more difficult times (increased spending, decreased revenue, etc.). Indeed, a shorter period will lead to a lower total cost of credit, but in this situation, a higher monthly installment may unbalance the monthly spending budget.

- Choosing the highest amount for which you are eligible may also mean the highest amount of the monthly instalment, that is the total cost of the credit. The amount of funding should be linked to the amount of the monthly instalment so that it is sustainable and in balance with monthly revenue and expenditure.

- You can repay partially or totally the credit earlier, without additional costs.

- It is best to set it a few days after your main monthly income date (salary, other income).

- Thus, you can better manage your expenses and conveniently assign a part of your monthly income for your monthly installment reimbursement.

- You have the choice that monthly payment obligations will be automatically debited from any account opened with the Bank, without having to transfer the corresponding amount to the credit escrow account.

- Bringing your salary to UniCredit Bank can offer you better costs, under the terms and conditions stipulated in the contract, as well as convenience in the administration of the credit.

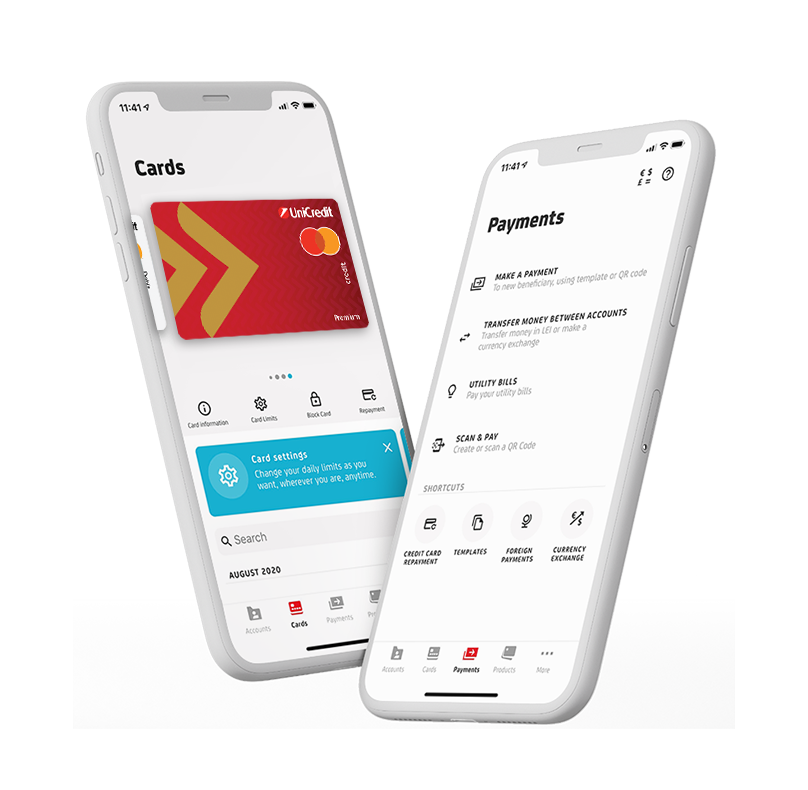

- If your employer does not pay your salary in a current account opened at UniCredit Bank, you can move it by yourself. The "Add money" functionality in Mobile Banking allows you to quickly transfer amounts from your accounts opened at other banks, using a debit or credit card issued by them, to your current account in Lei from UniCredit Bank.

*Credit cards issued by UniCredit Bank and UniCredit Consumer financing are excluded.

Why are insurances a “safety net”?

The benefits of a life insurance

Depending on the contractual terms of your insurance, the insurer will pay an indemnity in the event of an unfortunate event (death or disability), or in the case of temporary loss of employment or unemployment (where it can cover a fixed number of monthly instalments).

You can find more information about the life insurance intermediated by the bank on the life insurance for loans page.

Benefits of the Property Insurance

The property is always insured at the evaluated value (the market value in the valuation report at the credit granting date or reported by the bank thereafter following regular revaluation by the bank). In the case of newly built house credit the immovable property is insured at the assessed value, but not less than the market value from the date in which the loan was granted, as communicated by the guarantee request.

Together with optional home insurance, you have to purchase, together or separately, the policy of the DAP - compulsory insurance of housing against earthquakes, landslides and floods as natural phenomena - regulated by law.

You can opt for the insurance of buildings brokered by the bank. Details on the home insurance page.

When purchasing a house, consider the following:

The price of the property

The funds available for the advance

Funds available for additional expenditure on the purchase of the building and the contracting of the credit:

- Analysis fee;

- Notarial fees and fees for authentication of the sales contract, real estate mortgage and rental mortgage, if applicable

- Advertising of securities in the NPM

- Real estate broker fee (if applicable)

- Life insurance expenses (if applicable and opt for)

- Expenditure on the insurance of buildings

- Cost of the building valuation report

Don't forget:

- Expenses for repairs and the furniture or equipment of your home - regardless of your future plans, you find financing solutions suitable for your needs. Find out more about the Personal Accomplishments Loans or Credit Cards offered by UniCredit Consumer financing IFN S.A. through UniCredit Bank S.A., Credit intermediary to credits provided by UniCredit Consumer financing IFN S.A.

- Potential exchange rate differences if the price of the building is in other currency than RON

- Taxes

What documents are needed to get the loan – useful information, who, why and from where do they get them?