We promote financial education as a way to support micro-enterprises and social enterprises when they are established. Our investments target and support vulnerable groups, especially young people and those at risk of exclusion, by creating better financial awareness to enable their inclusion.

We invest in national programs to help students get jobs, providing financial education and entrepreneurial training.

Through financial education, UniCredit's Social Impact Banking structure uses its core competencies to promote financial education and to support the development of micro-businesses and social enterprises, provide jobs for young people and promote the inclusion of vulnerable people or groups.

Beneficiaries:

a) pupils / students

b) vulnerable individuals at risk of social exclusion (eg immigrants, representatives of religious minorities or ethnic groups, persons with physical or physiological disabilities, victims of violence or drug abuse, detainees or former detainees, etc.)

c) micro-enterprises or social enterprises or in general companies considered vulnerable as a level of maturity or training necessary to maintain the company's finances and ensure its sustainability, e.g. startups, social enterprises, small family farms, micro-businesses run by disadvantaged groups, women micro-entrepreneurs, etc.

UniCredit Bank’s educational programs

Creative Minds Academy

UniCredit Bank’s financial and entrepreneurial educational program started 3 years ago and has had 11 editions in Bucharest, Cluj, Timisoara and Iasi. Recently it expanded nationwide through the digitalization of its courses. The academy is a school where mentors are professionals from relevant business sectors, volunteers from the bank, innovative entrepreneurs who train the students based on their experience.

Along with the Creative Minds Barometer (the first research in Romania on the obstacles and perspectives of creative entrepreneurs), Creative Minds Wednesday (the first shopping and socializing festival dedicated to creative businesses), the 24/7 Guide and the Creative Package, it is part of the UniCredit Bank support platform of micro-entrepreneurs in Romania.

Read more information about the Creative Minds Academy and its courses.

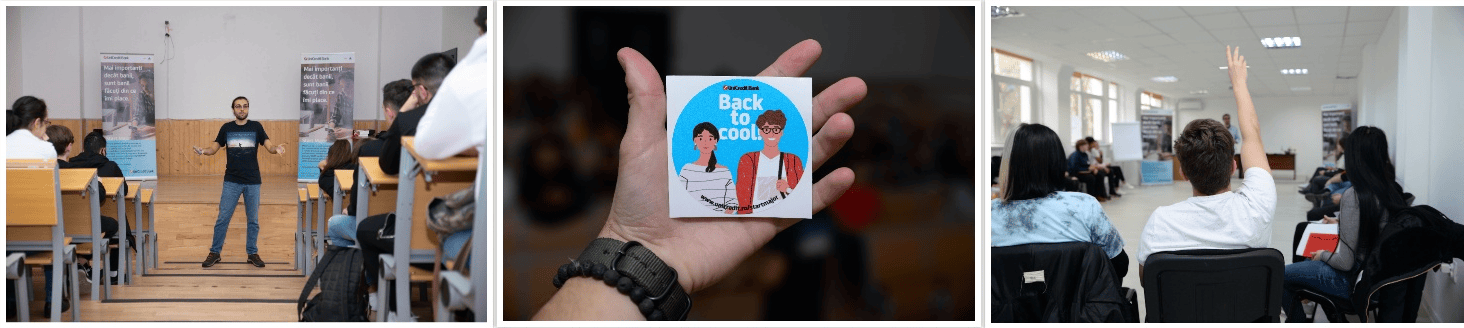

Start Major

The financial and career educational program initiated by UniCredit Bank aims to prepare students in vocational and technical high schools for financial independence. Start Major started in October 2019 in 10 technological high schools in Bucharest and is developed in partnership with the Leaders Foundation and OLX Jobs.

The program is designed to increase students' chances of financial independence and career success once they turn 18. To make it easier for them to get the money they need, by doing what they love, and to manage their money responsibly.

We train high school students on how they can get a job more easily, what they need to know in order to grow their own business, but also on how they can use the available financial resources efficiently.

Start Major is specially designed for students in vocational and technical education, who want to make the best financial decisions and start their careers after graduating from high school. It is the place where education is tailored to their needs, where students become part of the learning process and where they can stand face to face with specialists ready to help them on the road to independence.

Start Major started as an offline educational program in the classroom, which we took in digital out of the desire to continue to be close to the participants enrolled in the program. The interactive and informal approach will be central also in the digital version of the in-depth entrepreneurship education camp.

Read more information about the Start Major campaign.