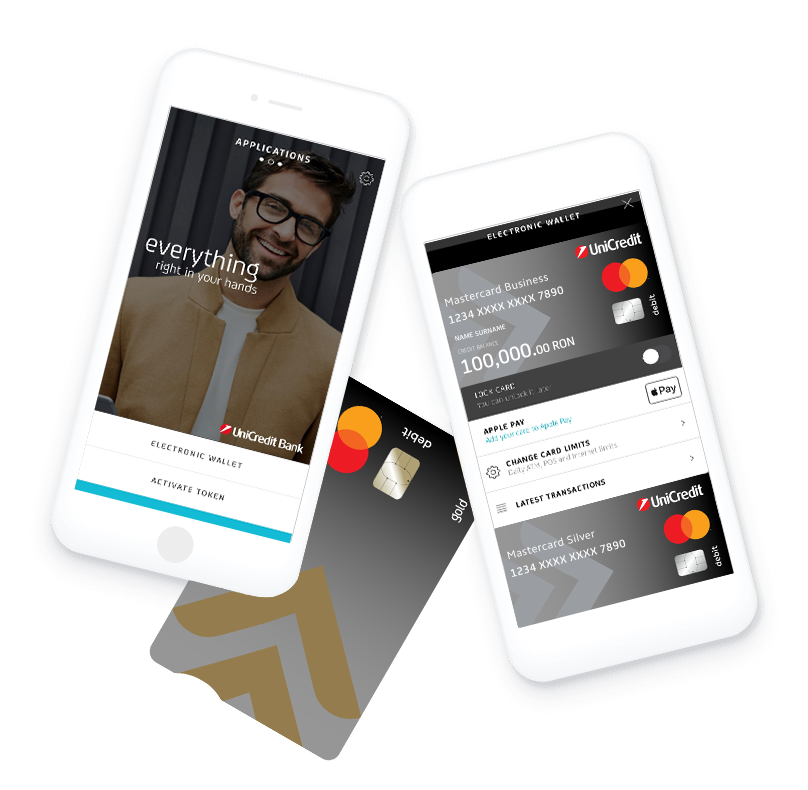

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

for your business

You save advantageously

ZERO fee for opening and maintaining the term deposit

The interest rate is fixed throughout the period of establishment of the deposit

Save without worries, in Lei, EUR or USD

Easy to manage via BusinessNet

The safety of your savings is our priority.

The term deposit for SME Micro companies offers savings options in lei, dollars and euros for a term of one month, 3 months, 6 months or 1 year, depending on the sustainable planning of your business. In addition, for term deposits in lei, you also have the option of saving for a week.

The amount required to open a term deposit is 10,000 LEI or 3,000 USD or 3,000 EUR. You can replenish the deposit account from the current/savings account upon incorporation.

The deposit interest is fixed throughout the deposit period until the first maturity.

![]() Single maturity deposits: at maturity, the interest and the principal are transferred to the current account. This type of deposit is recommended for situations where you know exactly when you want to have these funds;

Single maturity deposits: at maturity, the interest and the principal are transferred to the current account. This type of deposit is recommended for situations where you know exactly when you want to have these funds;

![]() Deposits with automatic extension, without capitalization: at maturity, the interest is transferred to the current account, and the deposit is extended only with the amount of the initial deposit. This product allows you to use the interest of a bank deposit as a source of income;

Deposits with automatic extension, without capitalization: at maturity, the interest is transferred to the current account, and the deposit is extended only with the amount of the initial deposit. This product allows you to use the interest of a bank deposit as a source of income;

![]() Deposits with automatic extension and capitalization: at maturity, the interest is added to the initial deposit, and the deposit is renewed with the balance thus obtained. The advantage is that the interest amount increases with each extension, due to the increase in the amount deposited with the interest previously obtained.

Deposits with automatic extension and capitalization: at maturity, the interest is added to the initial deposit, and the deposit is renewed with the balance thus obtained. The advantage is that the interest amount increases with each extension, due to the increase in the amount deposited with the interest previously obtained.

| Currency | Term | Min. amount | % annual interest for deposit with/without automatic extension |

LEI |

1 week |

≥ 50.000 LEI |

3.0% |

1 month |

4.0% |

||

3 months |

≥ 10.000 LEI |

5.0% |

|

6 months |

5.1% |

||

12 months |

5.2% |

| Currency | Term | Min. amount | % annual interest for deposit with/without automatic extension |

USD |

1 month |

≥ 3.000 USD |

2.2% |

3 months |

2.7% |

||

6 months |

3.0% |

||

12 months |

3.3% |

| Currency | Term | Min. amount | % annual interest for deposit with/without automatic extension |

EUR |

1 month |

≥ 3.000 EUR |

1.5% |

3 months |

2.0% |

||

6 months |

2.3% |

||

12 months |

2.3% |

Deposits made at UniCredit Bank are guaranteed by the Bank Deposit Guarantee Fund (FGDB). The maximum guaranteed amount per client is the lei equivalent of 100.000 euro.

Loading