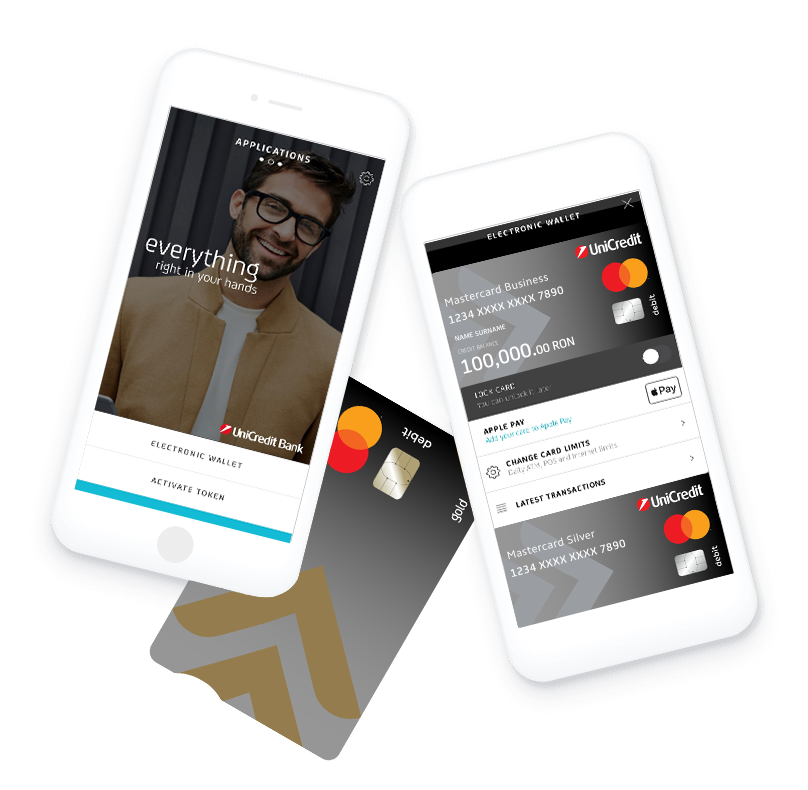

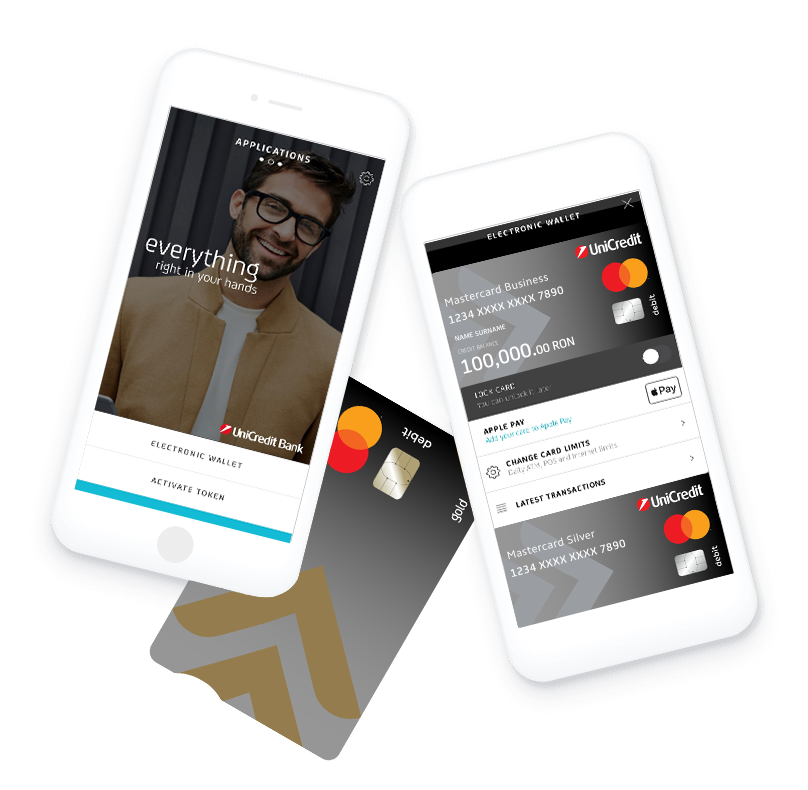

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Current activity

As an international bank we have solutions suited for the complex needs of mature, as well as growing businesses.

In addition to complex products and services, we cover basic business needs such as:

Incoming and outgoing payments in all major currencies and through any method (i.e. payment order, CEC or promissory note);

Deposits and cash withdrawals in both lei and foreign currencies;

Collection of invoices;

Payment of salaries;

Monitoring of company account transactions via InfoSMS;

Foreign exchange: regardless of the currency in which you want to receive or make payments, UniCredit Bank securely converts the currencies you work with.

You can access your money any time you want by using the SME debit card.

Share capital account is a bank account dedicated to help you establish your business. You may deposit your share capital value registered into this account.

Useful documents for opening a share capital account:

Certificate of incorporation* or the incorporation contract and articles of the company / association / foundation scheduled to be established, signed by the partners, shareholders, and founders;

Authorization of the person depositing the capital, if other than associate, shareholder, or founder;

The identity documents of the person depositing the share capital;

Written request completed and signed by the legal representative / company's authorized representative.

Depositing money in the share capital account:

Cash deposit at any UniCredit Bank cash desk;

Money transfer from any account.

Useful documents for changing your social capital account into your current account:

Certificate of company registration together with the

Conclusion of the Trade Register Office’s delegated judge which authorizes the establishment of the company and

The ascertaining certificate (original paper or digitally signed electronic version) of the Trade Registry (not older than 30 days attesting the date of issue of the registry, as well as the company’s recorded data i.e.: name, location, object of their activity partners / shareholders, auditors, company status, and so on) or RECOM online interrogation.

Costs:

Free opening and maintenance of your account;

Free cash deposits for the share capital amount;

Free cash withdrawals for the share capital amount;

Free conversion of a share account into a current account.

*Authentic incorporation forms are mandatory when:

Land is one of the share capital’s contributing goods;

There is a general or limited partnership;

Joint company is constituted by public subscription.

To help you with transactions within your company, we provide these trade finance products*:

Guarantee letters

A letter of guarantee is an irrevocable and unconditional commitment undertaken by a bank at client request. It’s a written form regarding the payment of a sum of money to the collateral taker, following the presentation by the latter of an application for payment in accordance with the terms of the letter of guarantee. The letter of guarantee is thus a way to ensure the fulfillment of contractual obligations of a company to another company. Bank guarantees are regulated locally by art. 2.321 of the Civil Code, and can also be subjected to international rules of request safeguards Uniform Rules for Demand Warranties (URDG) - revised in 2010 - Publication No. 758 of the International Chamber of Commerce, Paris.

UniCredit Bank can offer you letter of guarantee issuance lines in order to optimize your transactions. For more details on using letters of guarantee and how they can support your business, please contact the bank.

To support your business, UniCredit Bank offers these types of letters of guarantee (or standby letters of credits – a particular form of credit that acts as a guarantee instrument):

Documentary credits (Import - Export)

A Documentary Letter of Credit is one of the most popular methods of payment in international trade (but also increasingly used in local trade), that provides the exporter-seller with an irrevocable commitment of payment from the bank, and the importer-buyer with the assurance that payments will be made only when production is documented and in strict compliance with the terms and conditions determined by the letter of credit.

Please contact us for additional information regarding credentials and how they can support your business.

UniCredit Bank seeks the best solution depending on the specifics of your activity, and issues letters of credit to optimize company transactions. To this end, UniCredit Bank can access:

Incasso documentation (Import – Export)

Incasso is a procedure by which the bank processes commercial and/or financial documents in accordance with received instructions for:

Gaining acceptance and / or payment documents;

Submitting documents against acceptance and / or payment (if applicable);

Submitting documents according to other terms and conditions.

For more details regarding Incasso and how your business can access it, please contact us.

Exporters / vendors are assured that documents, subjected to the Incasso procedure, will come into possession of the importer / buyer only after the latter has carried out of their instructions. The banks have to make sure that the instructions are carried out.

* The presentation of the trade finance products above is indicative and representative of only a small part of documentary business and commercial hedging instruments. Our trade finance products and services constitute a complex array of solutions based on the peculiarities of every company and transaction.

Do you care about your company’s employee satisfaction? An employee banking offer can help.

Do you want to transfer salaries in a safe and effective way? Nothing could be simpler. If you have over 10 employees and want a banking offer for your employees, call a UniCredit Bank subsidiary to receive counseling on how to sign a pay agreement. You can also be contacted by filling in the APPLY NOW form.

Current account products and related services

There is a wide range of customized products and services that can meet real needs and can be accessed by employees at preferential prices.

Salaries can be cashed in the account opened with UniCredit Bank and can be used by your employees for cash and specially debit card:

Cash withdrawals (ATM and cash desk);

Payments to retailers (POS).

Amounts of money are available to your employees as overdraft at preferred prices without a granting fee. This is a product for financing current needs that they can use both for cash withdrawals and shopping.

Easy access to banking offers

A Bank representative can properly advise and present the offer to your employees at the company.

Access to offers and promotional campaigns

By becoming UniCredit Bank clients, your employees can access various campaigns and promotional offers that are specially created to their advantage.

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading