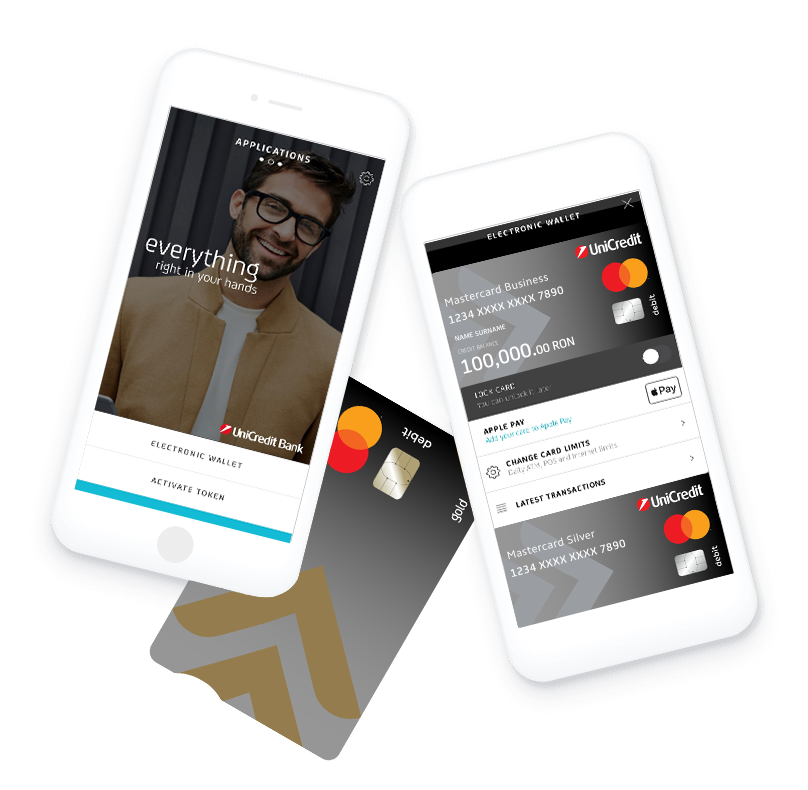

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

The debit card for companies separates your personal spending from your business spending.

You have a 24/7 access to company’s account and you can follow the evolution of your finances online, as well as through the activity report or the miniextract from the UniCredit Bank ATM.

Depending on the size of your business, the number and size of your monthly online transactions or if you have employees that travel abroad on business trips, we have debit cards that satisfy your business’ needs.

Loading