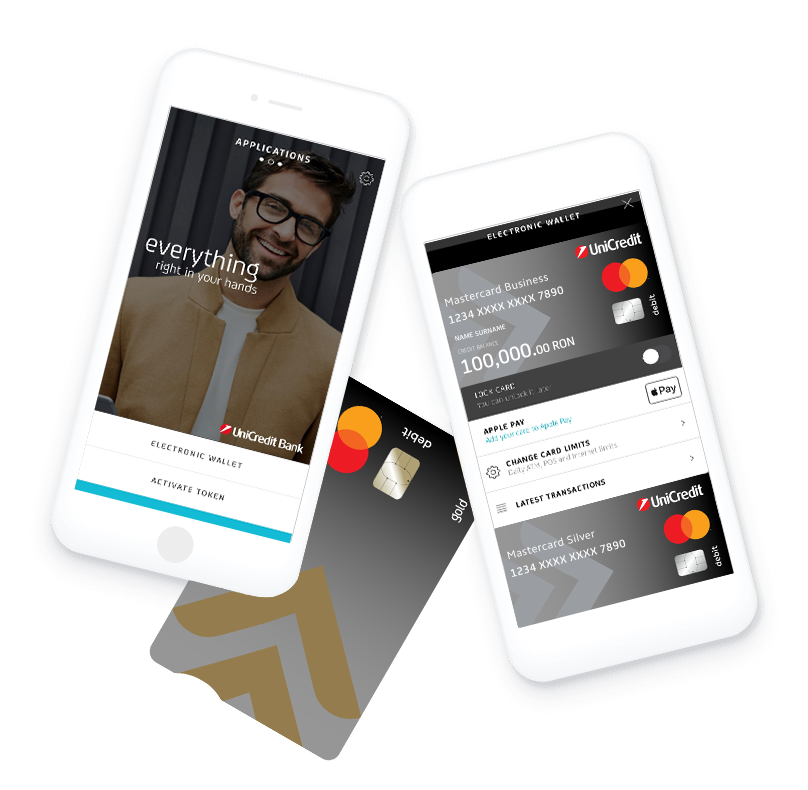

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

for SMEs

Find out more about how you can access funds through the Invest Eu,

Start-up Nation and Woman Antrepreneur programs

About the grant program for pandemic affected SMEs:

The program supports authorized individuals (PFAs), individual medical practices (CMIs), NGOs, micro and small and medium-sized enterprises (SMEs) affected by the COVID-19 pandemic in accessing grants from European non-reimbursable funds, totaling 1 billion euro, through the Operational Competitiveness Program (POC) 2014 - 2020 (regulated in Emergency Ordinance no. 130/2020 on some measures for granting financial support from non-reimbursable external funds, related to the Competitiveness Operational Program 2014-2020, in the context of COVID -19 caused crisis, as well as other measures in the field of European funds).

The state aid scheme granted by GEO 130/2020 administrator is the Ministry of Economy, Energy and Business Environment (MEEMA).

Grants will be awarded for financing contracts signed until December 31, 2020.

The state aid scheme provides 3 forms of support:

Micro-grants in amount of 2,000 euros (fixed amount) granted from non-reimbursable external funds in the form of a lump sum.

Grants for working capital between 2,000 euros and 150,000 euros granted to beneficiaries in the form of a lump sum and depending on their 2019 turnover.

Grants for productive investments granted to SMEs between 50,000 euros and 200,000 euros, depending on financing needs mentioned in submitted investment projects.

You can now apply for working capital grants here.

Types of grants

UniCredit launched the "UniCredit for CEE" initiative - an umbrella framework that offers concrete financing solutions, financial advice and account management, dedicated to supporting micro, small and medium enterprises in Central and Eastern Europe (CEE).

In Romania, we offer fast and advantageous solutions through the InvestEU, Recovery and Resilience Programs (RRF) - SME Competitiveness and Sustainability and EaSI guarantee.

If you want to grow your business, UniCredit Bank now offers you guaranteed loans to develop and access new opportunities. Through the InvestEU programs and the Recovery and Resilience Program (RRF) - SME Competitiveness and Sustainability, you can benefit from advantageous financing, whether you need working capital or want to invest in the long term.

The InvestEU guarantee instrument

Through InvestEU, UniCredit Bank offers you working capital loans (revolving and non-revolving), and also financing for investments, all supported by advantageous guarantees.

Find out how you can get the financing to take your business to the next level, on each component of the program!

Sustainability:

Financing up to EUR 7.5 million per transaction*.

Financing up to EUR 7.5 million per transaction*.

Guarantee between 30% and 80%, with a maturity period between 12 and 48 months for revolving working capital and up to 144 months for investments.

Guarantee between 30% and 80%, with a maturity period between 12 and 48 months for revolving working capital and up to 144 months for investments.

Guarantee fee: 0.2% per year, paid quarterly.

Guarantee fee: 0.2% per year, paid quarterly.

*represents the maximum exposure of the beneficiary with FEI guarantees under the InvestEU Umbrella/ under the RRF, with the exception of Small Mid Cap clients. In the case of Small Mid Cap clients, the amount of EUR 7,500,000 represents the maximum exposure of loans with guarantees from the InvestEU Umbrella + RRF, as well as any financial aid obtained by the beneficiary from the InvestEU Fund, according to the declaration on his own responsibility (Financing Application)

Skills & Education:

Similar financing, with a guarantee of up to 70% and the same maturity conditions (12-48 months for revolving working capital and up to 144 months for investments).

Similar financing, with a guarantee of up to 70% and the same maturity conditions (12-48 months for revolving working capital and up to 144 months for investments).

Guarantee fee: 0%.

Guarantee fee: 0%.

Innovation & Digitalisation:

Up to EUR 7.5 million per transaction.*

Up to EUR 7.5 million per transaction.*

Guarantee between 30% and 80%, on a maturity of 12-48 months for revolving working capital and up to 144 months for investments.

Guarantee between 30% and 80%, on a maturity of 12-48 months for revolving working capital and up to 144 months for investments.

Guarantee fee: 0.75% per year.

Guarantee fee: 0.75% per year.

Cultural & Creative Setor:

Financing and guarantees similar to those in innovation and digitization.

Financing and guarantees similar to those in innovation and digitization.

Guarantee fee: 0.75% per year.

Guarantee fee: 0.75% per year.

Benefit for your business: Reduction of the interest margin for transactions guaranteed by InvestEU, which means that you will obtain the necessary financing at a lower cost and with flexible terms. If you want to develop your business, this is the perfect opportunity!

Recovery and Resilience Program (RRF) - SME Competitiveness and Sustainability

Through the Recovery and Resilience Program, UniCredit Bank helps you access working capital loans (revolving and non-revolving), supported by EIF guarantees. If you want to grow your business and become more competitive, this program offers you the perfect solution!

Through this program, we offer working capital loans (revolving and non-revolving) for competitiveness projects and credit facilities for working capital investments (revolving and non-revolving) for sustainability projects.

The program is available until 13/12/2026, thus providing an extended period to access funding.

The guarantees cover between 30% and 70% of the loan value (50% for the Bucharest-Ilfov region) for which a guarantee percentage fee of 0.75% per year is applied, on the difference between the standard rate and the one granted within the program

The benefit for the client: The reduction of the interest margin, applied to the difference between the standard margin and the guaranteed one, allowing access to financing with much more advantageous conditions than the standard ones UniCredit remains a reliable partner for SMEs in Romania, offering customized solutions and support for the sustainable and competitive development of small and medium-sized businesses.

EaSI guarantee

This program facilitates access to financing for small entrepreneurs, with up to 10 employees, who want to expand their business or implement new projects. UniCredit offers loans for working capital with repayment for a period of up to 36 months.

European Investment Bank Guarantees for Large Enterprises

These guarantees are under the State Aid and De Minimis Scheme to facilitate companies' access to financing through guarantee instruments from the Fund of Funds for Digitalization, Climate Action and other areas of interest. Information about the Guarantees Program financed by the National Recovery and Resilience Program can be found in the presentation which can be accessed here.

Do you want to develop your business? UniCredit Bank is with you!

Depending on the sector in which you operate, UniCredit Bank now offers you financing solutions adapted to your needs. If you want to grow your business, we offer loans with EIF guarantee for working capital or investments so that you can fulfill your plans.

Contact us and learn more about how you can get the right financing for your business. Let's build your success together!

Loading