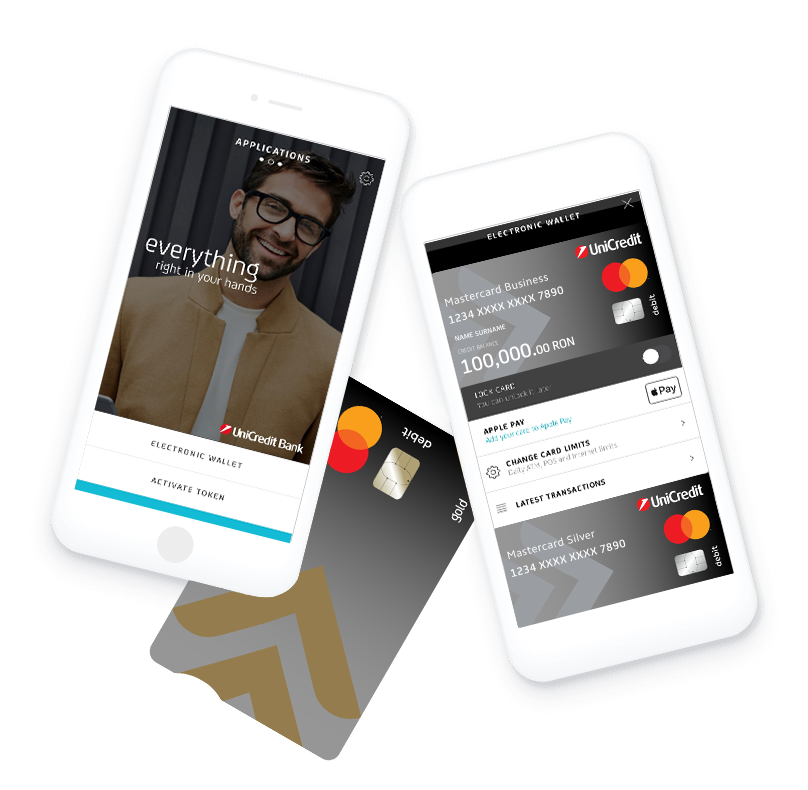

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Financing your business's general needs

Your business plan can be achieved faster with UniCredit Bank's support.

Working capital line for small and medium enterprises

We know it’s hard to start a new business, but you can easily get the support you need to make it grow!

That’s why we offer you working capital line for small enterprises.

Choose the 12-month credit line, which you can renew at maturity, and for which all utilizations and repayments can be easily realized via BusinessNet.

Benefits of the working capital line:

For current payments, the Business Credit Card or the General Needs Term Loan may be useful.

Working capital line - overdraft type for small and medium enterprises

We know it’s hard to start a new business, but you can easily get the support you need to make it grow!

That’s why we offer you the working capital line - overdraft type for small enterprises.

Choose the 12-month credit line, which you can renew at maturity.

Benefits of the working capital line - overdraft type:

For current payments, the Business Credit Card or the General Needs Term Loan may be useful.

The loan is addressed mainly to companies that want to correlate their incoming payments related to commercial contracts with the reimbursement schedule of a bank’s loan or to those that want a clear product’s reimbursement scheme for a better control of their liquidities.

The loan is offered for a period of maximum 5 years and can be used for general expenses, raw materials, materials, inventories acquisition, commercial contracts financing.

This product also responds to the needs of companies that run seasonal activities.

You have the following benefits:

Loading