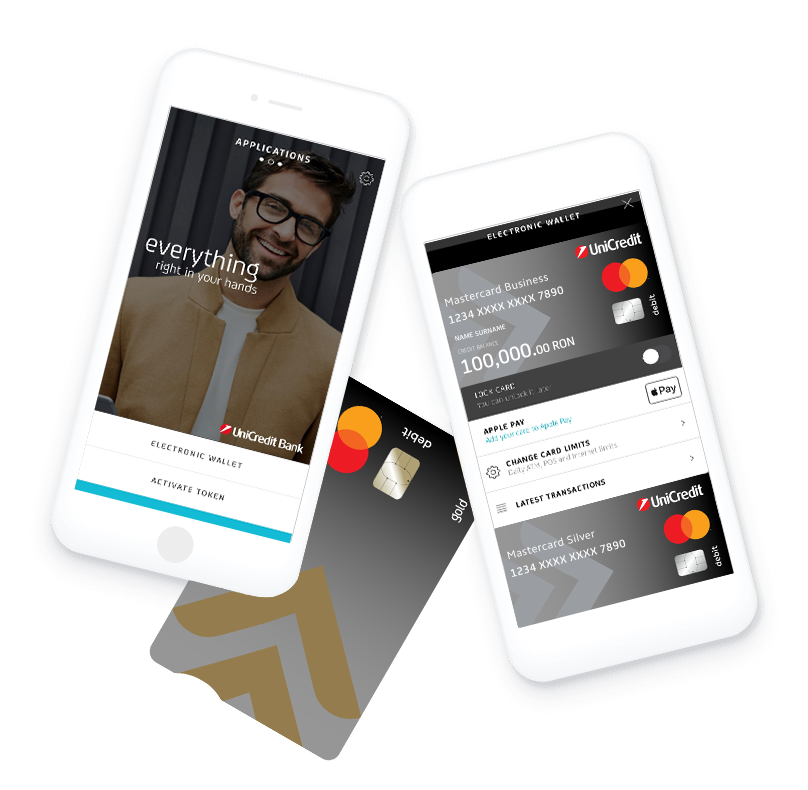

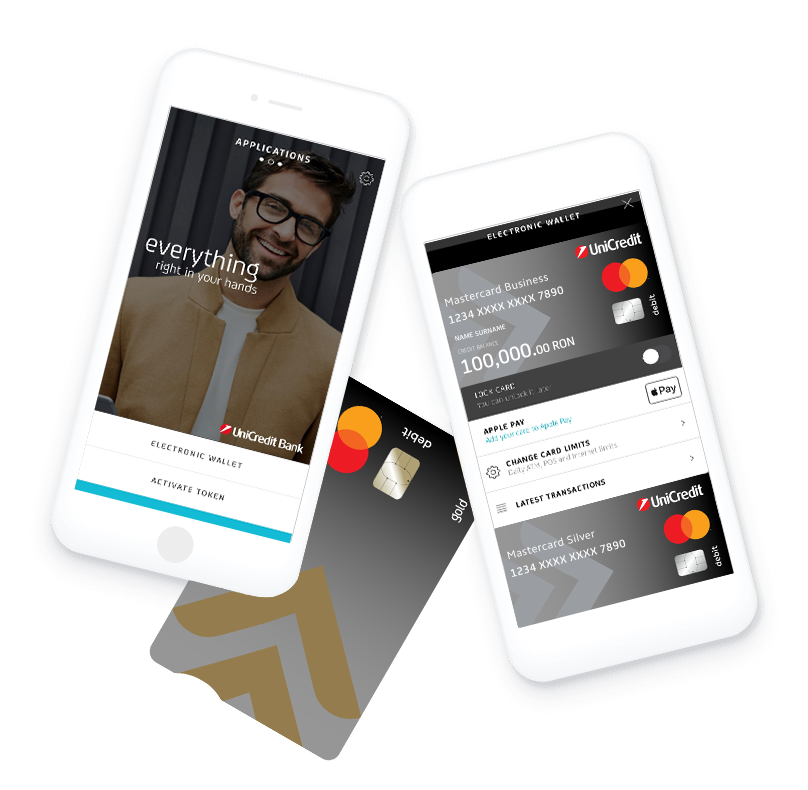

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Treasury

UniCredit Group is present on financial markets in Europe and worldwide, offering to clients a broad range of specific instruments for managing the financial risks to which entities in an open market economy are exposed to.

Currency risk

The companies with foreign currency funds or which have business activities with foreign partners are exposed to currency risk. Exchange rate fluctuations may bring major risks, but they can be controlled with the tools and strategies for managing currency risks.

At UniCredit Bank:

The portfolio for hedging currency risk contains:

UniCredit Bank specialists are available with complete information about offered financial products, including explanations of the each product’s associated risks.

Interest rate risk

Financial instruments may be influenced by interest rate fluctuations leading to unknown costs that may damage a business plan or even the financial stability of a company.

At UniCredit Bank:

The portfolio for interest rate risk hedging contains:

UniCredit Bank specialists are available with complete information about offered financial products, including explanations of the each product’s associated risks.

Commodities price risk

Companies with activity influenced directly or indirectly by commodities prices are exposed to the related fluctuations. Volatility generated risks can disrupt short term business plans and affect long term financial stability of the company. For risk-administered stategies:

In UniCredit Bank:

The portfolio of products for commodities risk hedging:

UniCredit Bank specialists are available with complete information about offered financial products, including explanations of the each product’s associated risks.

UCTrader Electronic Trading Platform offers state-of-the-art FX execution capabilities for more than 50 currencies and 140 currency pairs. The connection in the platform applies the new security protocols, each user account is using 2 factor authentication, requiring both a PIN or a password and a one-time passcode. The web interface is easy to deal with, the trade panel can be easily personalized based on preferences and, in addition, you have access in real time to the blotters with easy sort, filter and export functionality. Our Sales Treasury team is willing to offer additional details and is waiting for you to deal in UCTrader!

UniCredit Bank offers access to a vast market of investment instruments that contains sovereign bonds issued by Romanian Ministry of Public Finance.

Thus, investments can be diversified for yields, maturities, currencies and different risks.

At UniCredit Bank you may participate in both the primary market (purchasing sovereign bonds from the first issue) and secondary market (trading sovereign securities issued by Romanian Ministry of Public Finance).

All these instruments can be stored in a custody account opened in UniCredit Bank.

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading