The app you are looking for

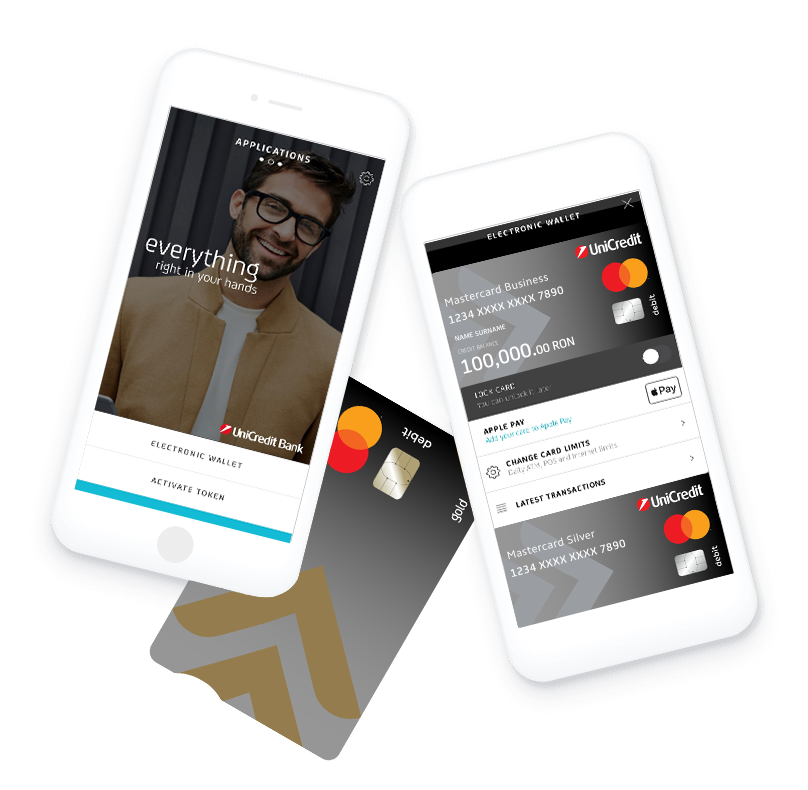

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

E-channels

Electronic applications, in addition to the periodic and fast reconciliation of the account statements, can help you manage account records as efficiently as possible.

BusinessNet Basic & Professional

BusinessNet is a web application that lets you make transactions from any computer that has Internet access. The application is in line with the highest security standards as well as ensures a framework for better banking operations. Communication with the Bank is ensured by the SSL protocol or with 256 bytes encrypting, combined with OTP (one-time password) based authentication devices, also known as "token". Thus, we ensure authentication and transaction confidentiality.

The service is available in two distinct versions: Basic and Professional. Both versions offer you a view of your company's accounts, your credit lines, and term deposits. You can visualize the details of all your transactions, including those made with cards, attached to the respective accounts.

See the log-in guide for BusinessNet

How to authorize your payments in BusinessNet using your Mobile Token - video

How to authorize your payments in BusinessNet using your Token - video

BusinessNet Connect

BusinessNet Connect is designed for large and medium-sized companies handling a high number of outgoing and incoming payments. This innovative solution streamlines internal processes and simplifies the procedure of active and passive communication between your company’s Financial and Accounting System (ERP) and BusinessNet Professional.

By synchronization the data between your Accounting System and BusinessNet Professional, you can automatically:

All financial data is available on your online ERP System, without having to manually import or export files.

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

Implementing a central finacial management is a necessity for more and more companies. UniCredit Bank helps you with this issue by creating a series of payment solutions.

Based upon the mandate received from a company that holds an account with our bank, UniCredit Bank accepts transfer instructions from third party banks via messages of the type SWIFT MT101 and makes payments according to such instructions. The company that holds an account with UniCredit Bank can only act as passive party.

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

Dear Customer,

Starting with 31st October 2016, EU Regulation No 260/2012 comes into force in Romania and imposes rules regarding credit transfers initiated in EUR currency to beneficiary banks in the European Union and European Economic Area. Thereby, from the perspective of your company`s relationship with the bank, the most important stipulations of the Regulation are:

Thus, starting with 31st October 2016, UniCredit Bank will accept payments files of Euro payments towards beneficiary banks from EU and EEA transmitted through electronic channels in XML format only.

Payments in other currencies and Euro payments to banks outside the EU and EEA will be accepted in current formats.

In order to assists you, we prepared the following documents:

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading