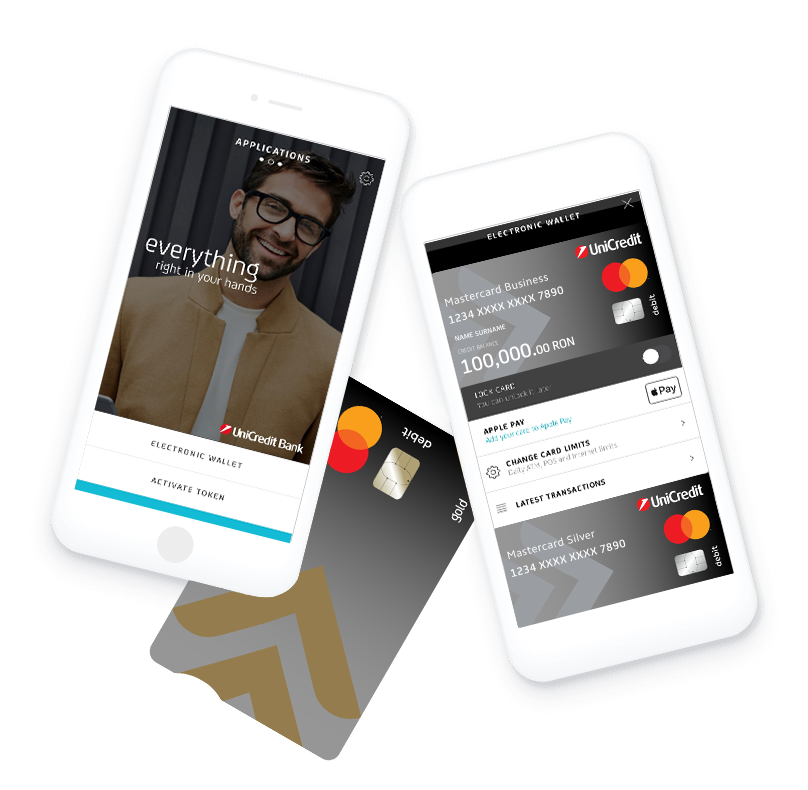

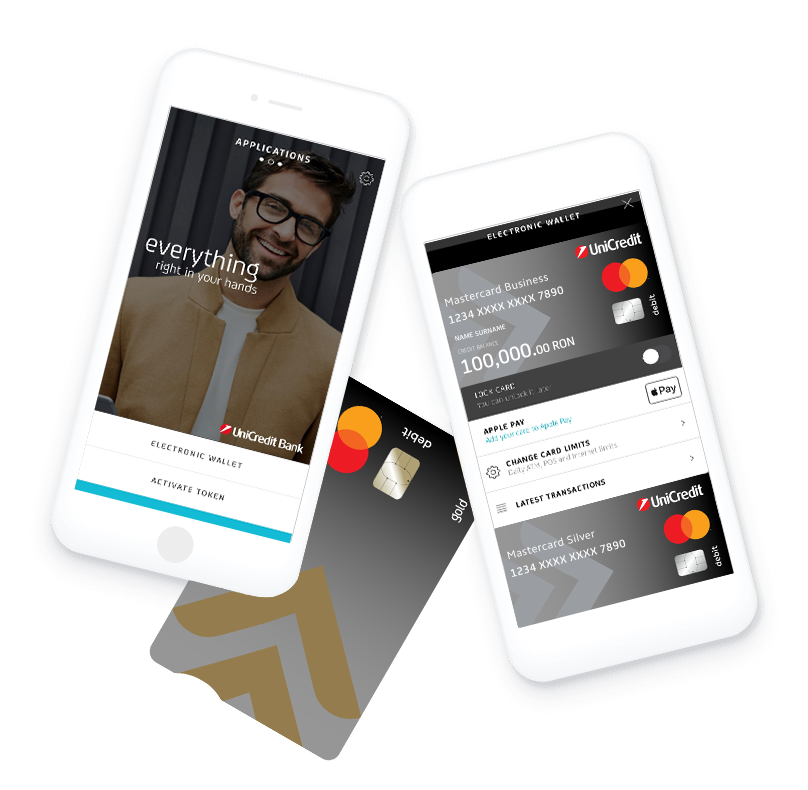

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Trade finance

We make guarantee and settlement instruments available, as well as structured funding means used in local or international commerce.

Documentary letters of credit is one of the most popular payment instruments used in the international commerce (used also, less frequently, for domestic trade) and gives the seller an irrevocable payment undertaking from the issuing bank, which simultaneously guarantees the buyer that payment will only be made when the receipt of the shipping documents presented are in strict compliance with the terms and conditions of the documentary letter of credit.

Letters of guarantee/ standby L/Cs are irrevocable payment undertakings issued by a bank, at its customer’s request, for the payment of a sum of money to the beneficiary of the guarantee, after the beneficiary makes a payment request to the Bank in accordance with the terms and conditions stipulated in the letter of guarantee. The letter of guarantee ensures a commercial contractual obligation (either a financial or a performance duty) and can take various forms depending on its purpose.

Documentary Collections – also called incasso - represent an instrument through which the bank processes documents (commercial and/or financial) received from the seller in accordance with their instructions, in order to:

If you have a commercial history with your client then Documentary Collection, as a payment method, is probably your best commercial option.

As a supplier or producer involved in the domestic or international supply or production of goods, turnkey projects, and related services, you may have to deal with a high level of complexities and risks. UniCredit Bank T & S Trade Finance team can help you with tailor-made solutions for:

Our product offer also includes: conditional payment orders (similar to the letter of credit mechanism, in its simplest form, without the international rules and standards applicable to L/Cs), escrow account or performance guarantee accounts (accounts bearing a particular lien, used to secure specific payment or performance obligations), comfort letters (commonly required by the public authorities during their acquisitions procedures) etc.

For additional information, talk to one of our product specialists at tradefinance@unicredit.ro or contact your Relationship Manager.

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading