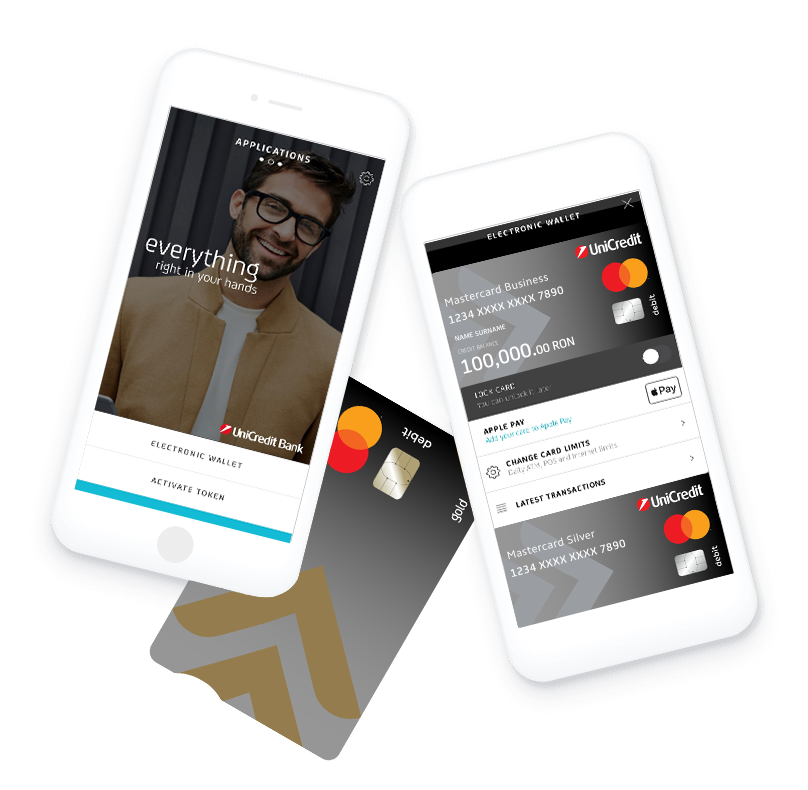

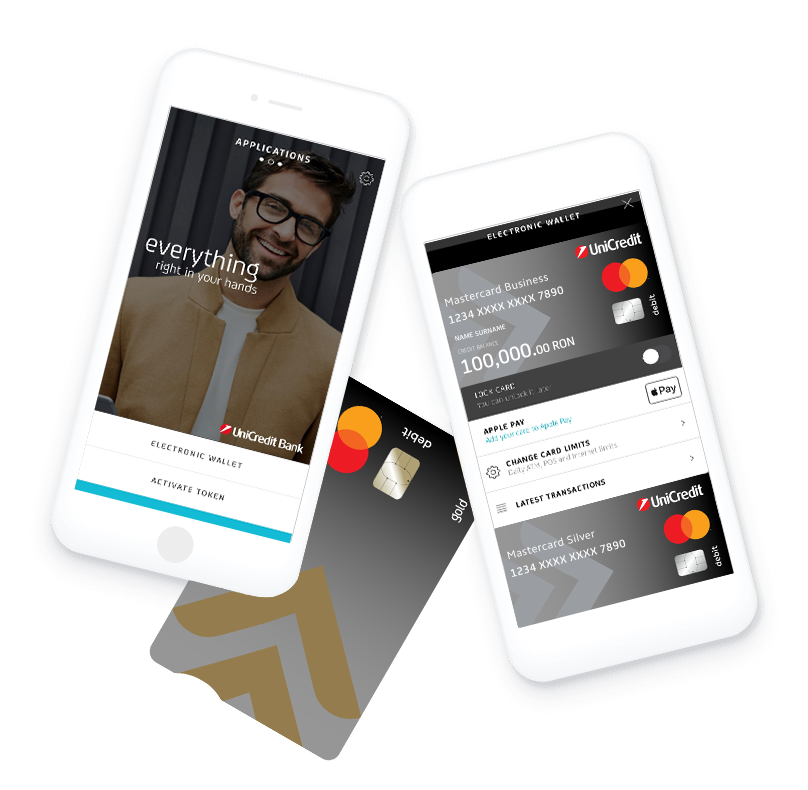

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Current account, liquidity management, payments and collections

We have developed both standard payment solutions and special collection solutions adapted to your company's activity.

For legal entities with annual Turnover higher than 1 million and up to 3 million EUR

PACKAGE FEE: 45 LEI / MONTH

Products and services:

![]() 2 current accounts in LEI;

2 current accounts in LEI;

![]() 2 current accounts in EUR and / or USD;

2 current accounts in EUR and / or USD;

![]() Business Debit card (Mastercard Business Silver sau Mastercard Business Gold);

Business Debit card (Mastercard Business Silver sau Mastercard Business Gold);

![]() Online & Mobile Banking: BusinessNet Basic / Professional with Mobile Token & Business Mobile;

Online & Mobile Banking: BusinessNet Basic / Professional with Mobile Token & Business Mobile;

![]() Info SMS.

Info SMS.

Transactions:

![]() Receipts in Lei and currency by payment order;

Receipts in Lei and currency by payment order;

![]() Intrabank payments in Lei and Currency through BusinessNet;

Intrabank payments in Lei and Currency through BusinessNet;

![]() 10 Interbank payments in LEI through BusinessNet from the main account included in the package*;

10 Interbank payments in LEI through BusinessNet from the main account included in the package*;

![]() Cash withdrawals in Lei with the debit card included in the package from UniCredit Bank/UniCredit Group ATMs and Euronet Romania ATMs;

Cash withdrawals in Lei with the debit card included in the package from UniCredit Bank/UniCredit Group ATMs and Euronet Romania ATMs;

![]() Transactions through UniCredit Bank Self Service machines (BNA) with the debit card included in the package or barcode;

Transactions through UniCredit Bank Self Service machines (BNA) with the debit card included in the package or barcode;

![]() Direct debit with UniCredit Bank partners.

Direct debit with UniCredit Bank partners.

Need more options in your current account package? No problem!

GeniusIMM current account package extraoptions

![]() Unlimited interbank electronic payments in Lei from accounts included in the current account package* -> 55 Lei/month

Unlimited interbank electronic payments in Lei from accounts included in the current account package* -> 55 Lei/month

![]() Unlimited interbank electronic payments in foreign currency from accounts included in the current account package * -> 65 Lei/month

Unlimited interbank electronic payments in foreign currency from accounts included in the current account package * -> 65 Lei/month

![]() Payments and receipts in Lei with cheques and promissory notes from/in the accounts included in the package* -> 100 Lei/month

Payments and receipts in Lei with cheques and promissory notes from/in the accounts included in the package* -> 100 Lei/month

![]() Unlimited withdrawals with the main debit card included in the current account package from any ATM in Romania -> 120 Lei/month

Unlimited withdrawals with the main debit card included in the current account package from any ATM in Romania -> 120 Lei/month

![]() Additional current accounts in Lei and currency (EUR, USD, HUF, CHF sau GBP) -> 12 Lei/month

Additional current accounts in Lei and currency (EUR, USD, HUF, CHF sau GBP) -> 12 Lei/month

*The freebies and discounts refer exclusively to the commissions charged by UniCredit. It does not apply to Sent/ReGIS commission, respectively the commissions of the correspondent banks.

For the products or services that are not included in the package, the standard fees and commissions are applied according to the list of commissions and interests in force.

More reasons to choose the GeniusIMM current account package from UniCredit Bank

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

You can benefit from the following types of payments:

The client companies of UniCredit Bank can pay the amounts due in lei by Direct Debit. If a company holds a current account at UniCredit Bank, they can sign a DD mandate; thus, the payment obligations to different suppliers shall be automatically performed by means of the DD instructions issued by the supplier.

We also offer the possibility of signing electronic Direct Debit Mandates for the agreed beneficiaries by means of our BusinessNet Basic/ BusinessNet Professional applications;

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

These solutions will be discussed together with your technical specialists in order to establish general aspects (collection accounts, criteria validation, algorithm implementation etc.).

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

For additional information, you can contact us at cashmanagement@unicredit.ro or through your Relationship Manager.

Solutions for effective domestic and cross-border concentrations of liquidites within the UniCredit Group for holding companies and/or groups of companies:

Our pan-European leading banking network, with more than 8,500 branches, offers the most modern banking services in over 17 countries. Through dedicated Cross Border Relationship Management, we are able to organize our customers' banking relationships in multiple countries, so that they receive the same quality of service abroad as they do at home.

Our top tier experts as well as the 4,400 parter banks worlwide contribute in developing and sustaining these innovative solutions. Everything is done in the easiest way possible: your local Relationship Manager is your unique point o access in the UniCredit network.

A client of UniCredit Cross Border has a special status, and:

Our Cross Border client has a special status:

Enjoys special treatment in the UniCredit Group;

Receives favorable offers based on the effective management of cross border activities;

Can quickly and efficiently access unique business opportunities through our range of innovative services.

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading