Social Impact Banking is UniCredit's commitment to building a fairer and more inclusive society. Its aim is to identify, finance and promote people and enterprises that have a positive social impact. Helping to develop the communities where we operate is a cornerstone of our mission as a bank.

This approach seeks to generate both economic returns of our investments and wider benefits for the communities. As well as continuously providing financing to projects and organisations that are generally excluded from traditional banking products and services, SIB allows UniCredit to share its financial and business know-how through educational initiatives dedicated to micro-entrepreneurs, social enterprises and vulnerable or disadvantaged groups, including young people, the elderly and others at risk of social exclusion.

Following the successful 1st year in Italy with € 72.9 million of impact financing approved, UniCredit gradually rolled out the platform to additional markets in 2019, to: Romania, Germany, Austria, Serbia, Croatia, Hungary, Bulgaria, Turkey, the Czech Republic and Slovakia, Bosnia and Herzegovina.

Our ambition is to help achieve the Sustainable Development Goals set by the United Nations. In particular, we have chosen to focus on promoting quality education, developing initiatives for the good health and well-being of disadvantaged people, championing gender equality, supporting job creation and economic growth, and reducing inequality.

We are not alone in working towards these goals. With the support of a variety of like-minded partners who share our objectives, we have built a broad network to champion the sustainable development goals. More than that, the engagement of UniCredit’s employees is a key driving force behind the training and support activities provided through SIB, which help build valuable networks within the communities where the Bank operates, bringing people together to share positive experiences and raising awareness of relevant projects to increase their potential impact. SIB also has a strong focus on monitoring and the measurement of outcomes, which is essential for ensuring the sustainable growth of both the sponsored projects and the Bank’s investment returns. The aim is to measure not only the direct, but also the indirect positive impacts generated by the projects backed in terms of social and economic well-being within UniCredit’s communities.

Key concepts

BUILDING TRUST

We develop long-term relationships with the businesses we support and with our partners.

MEASURING OUTCOMES

We help deserving organizations to prosper, ones that should serve to inspire others. This is why we believe that monitoring and measuring outcomes and social impacts is essential for sponsored projects to grow.

GENERATING SOCIAL IMPACT

We support initiatives that generate a positive social impact on people and the community. We help them achieve their goals, by providing not only finance but also expertise and support networks. By doing so, we can strengthen our ties with the communities where we work.

Our approach

We provide finance, expertise and networks for deserving projects and people, retaining an open-minded approach to external needs and ideas in order to foster a growth process that works both ways.

How we help social initiatives

PROVIDING FINANCE

We finance projects and organizations that are otherwise excluded from traditional banking products and social enterprises that have a positive impact on society

SHARING EXPERTISE

We share our financial expertise and support organizations in their growth, to help them do what they do best.

BUILDING NETWORKS

We build networks uniting various community players, share positive experiences, and raise awareness of the most deserving initiatives to help magnify their impact.

UniCredit has long been engaged in a number of social initiatives. The launch of Social Impact Banking marks a significant increase in our level of commitment, with three action areas leading towards the final goal of having a positive social impact in the communities where we work.

We support businesses and non-profits that generate clear, real and measurable social outcomes for the community. As well as soft loans, we provide support through financial education, sharing success stories, and helping to magnify visibility.

We reward projects that demonstrate a clear social impact through financial benefits (grants, lower interest payments, etc.) and extra services (mentorship, training, etc.), as part of a pay for success approach.

Impact financing is a medium-long term loan for projects and organizations that – in addition to the economic benefit – have a positive and measurable social impact and here can be included:

Profit-oriented companies, that intentionally pursue a positive and measurable social goal;

Non-profit companies that, even developing products and/or services for internal use and only partially for the market, reinvest the profits obtained to achieve the object of activity of the company. These are especially companies with a focus on philanthropic activities, social health, culture, sports and research, generally pursuing social interests through their activity;

Partnerships between public and private sector companies, which aim to generate a positive and measurable social impact, in which private property and/or the governance model prevail.

Independent initiatives of public sector companies (for example, state-owned, controlled, state-run institutions, regions or municipalities), even they target the common good, cannot be considered impact financing, because the objective of impact financing is to stimulate and support, with the involvement of the public sector, the creation of a dedicated market, whose objective is to deliver a tangible social impact.

Among the main target sectors, UniCredit Romania focuses on activities and projects that act and deliver social impact in the following areas:

Health and wellbeing

Wellness

Social houses

Training and Education

Conservation and restoration of cultural and artistic heritage, social tourism

Urban renewal of suburbs

Services for inclusion and reintegration on the labor market of disadvantaged and vulnerable workers and individuals

Other sectors may also be considered to the extent that they produce social impact, as recognized by local legislation or by supranational agency programs that encourage social impact initiatives. At the same time, the eligible individual transactions will comply with the eligibility criteria described below. Transactions that deliver social impact in sectors other than those listed above are conditioned by compliance with the Social Impact Banking policy of the UniCredit Bank Group.

Eligibility criteria for assessing the social dimension:

Intentionality – refers to an investment/initiative with the intention of generating positive social results;

Additionality – refers to the extent to which certain social results are produced as a result of the activity/project financed, which would not have occurred in the absence of intervention;

Measurability – refers to the commitment of the funded party to measure and report the social performance and progress of the funded impact investment, ensuring transparency and accountability for the project;

Financial Sustainability – refers to the capacity of the initiative/company to be economically and financially sustainable. In other words, the counterparty must have the capacity to generate sufficient profit/cash flow deriving from business/activity, as much as to allow the repayment of the debt.

We support the start-up and growth of small businesses through microcredit programs that combine access to finance with supplying the fundamental skills and networks they need for growth. Our new microcredit program goes beyond the regular commercial relationship between a bank and a business customer. Instead, it aims to create a support network that binds together the bank, our partners and volunteers, helping our customers through specific mentorship programs.

Microcredit is a short-term or medium-long term financing instrument that does not exceed the amount of EUR 25.000, aiming at financial inclusion and helping to form and develop small companies and micro-enterprises. Unlike other financing products with similar characteristics, microcredit, in the context of Social Impact Banking and according to these rules, is a product dedicated to customer groups that have difficulty accessing traditional financing services.

The clients to whom they are addressed are small companies and micro-enterprises that are at risk of financial exclusion. The precise target segment is defined by each bank based on the local market and social circumstances, as well as the local business strategy provided that the financed company does not exceed EUR 2 million annual turnover or assets and has less than 10 employees. The product can be targeted to specific categories, such as women entrepreneurs, family farms and start-ups or other categories that at the country / region level may be at risk of financial exclusion.

Given the inclusive nature of the product, when possible and only in compliance with the applicable credit risk policy and at the same time using risk hedging tools (eg guarantees), microcredit products can be extended to high risk categories.

Product offer

The value of a single loan will not exceed EUR 25.000

Maximum maturity: 5 years + grace period

Product type: working capital line or investment credit

Microcredit financing is offered at a competitive price - at the level of the offer of the best players on the local market. The price level and the price configuration tools are managed entirely by the local bank.

No real guarantees will be requested from the clients, however the bank considers requesting an external guarantee for this product.

Non-financial characteristics - we include in the offer additional non-financial services that accompany the microcredit products as follows:

- assist potential clients in preparing the credit application and on the economic and financial plan, relying mainly on the complementary support of third parties such as partners, volunteers, associations, etc. The support of third parties is based on volunteering, it must not be remunerated by the bank or by the client.

- complementary support to the client in the post-use period for the development and consolidation phase of the financed initiatives (eg complementary services, tutorial, trainings on management aspects, etc.)

Service Model

Partnerships

The Bank may use partnerships with trusted external organizations that share the inclusive mission of the Social Impact Banking initiative to access the target group and provide non-financial support (including but not limited to assistance in developing the credit application and/or preparing business plans). These may include social or innovation centers, the organization of business networks, cooperatives, public or private non-profit organizations.

The support given by partners or third parties is based on volunteering and must not be remunerated by the bank. Any service that is to be paid for by the client must be agreed and formalized in advance between the partner and the bank.

Support from Social Impact Banking volunteers

Given the alleged vulnerability of micro-enterprises and their competencies, the service model may include free support from volunteers in providing financial services or other specialized expertise in the post-use period.

We promote financial education as a way to support micro-enterprises and social enterprises when they are established. Our investments target and support vulnerable groups, especially young people and those at risk of exclusion, by creating better financial awareness to enable their inclusion.

We invest in national programs to help students get jobs, providing financial education and entrepreneurial training.

Through financial education, UniCredit's Social Impact Banking structure uses its core competencies to promote financial education and to support the development of micro-businesses and social enterprises, provide jobs for young people and promote the inclusion of vulnerable people or groups.

Beneficiaries:

a) pupils / students

b) vulnerable individuals at risk of social exclusion (eg immigrants, representatives of religious minorities or ethnic groups, persons with physical or physiological disabilities, victims of violence or drug abuse, detainees or former detainees, etc.)

c) micro-enterprises or social enterprises or in general companies considered vulnerable as a level of maturity or training necessary to maintain the company's finances and ensure its sustainability, e.g. startups, social enterprises, small family farms, micro-businesses run by disadvantaged groups, women micro-entrepreneurs, etc.

UniCredit Bank’s educational programs

Creative Minds Academy

UniCredit Bank’s financial and entrepreneurial educational program started 3 years ago and has had 11 editions in Bucharest, Cluj, Timisoara and Iasi. Recently it expanded nationwide through the digitalization of its courses. The academy is a school where mentors are professionals from relevant business sectors, volunteers from the bank, innovative entrepreneurs who train the students based on their experience.

Along with the Creative Minds Barometer (the first research in Romania on the obstacles and perspectives of creative entrepreneurs), Creative Minds Wednesday (the first shopping and socializing festival dedicated to creative businesses), the 24/7 Guide and the Creative Package, it is part of the UniCredit Bank support platform of micro-entrepreneurs in Romania.

Read more information about the Creative Minds Academy and its courses.

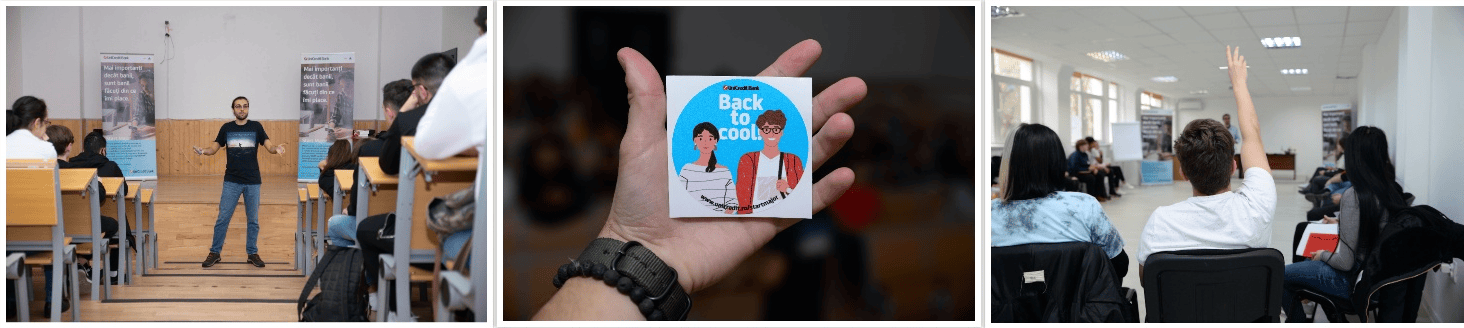

Start Major

The financial and career educational program initiated by UniCredit Bank aims to prepare students in vocational and technical high schools for financial independence. Start Major started in October 2019 in 10 technological high schools in Bucharest and is developed in partnership with the Leaders Foundation and OLX Jobs.

The program is designed to increase students' chances of financial independence and career success once they turn 18. To make it easier for them to get the money they need, by doing what they love, and to manage their money responsibly.

We train high school students on how they can get a job more easily, what they need to know in order to grow their own business, but also on how they can use the available financial resources efficiently.

Start Major is specially designed for students in vocational and technical education, who want to make the best financial decisions and start their careers after graduating from high school. It is the place where education is tailored to their needs, where students become part of the learning process and where they can stand face to face with specialists ready to help them on the road to independence.

Start Major started as an offline educational program in the classroom, which we took in digital out of the desire to continue to be close to the participants enrolled in the program. The interactive and informal approach will be central also in the digital version of the in-depth entrepreneurship education camp.

Read more information about the Start Major campaign.