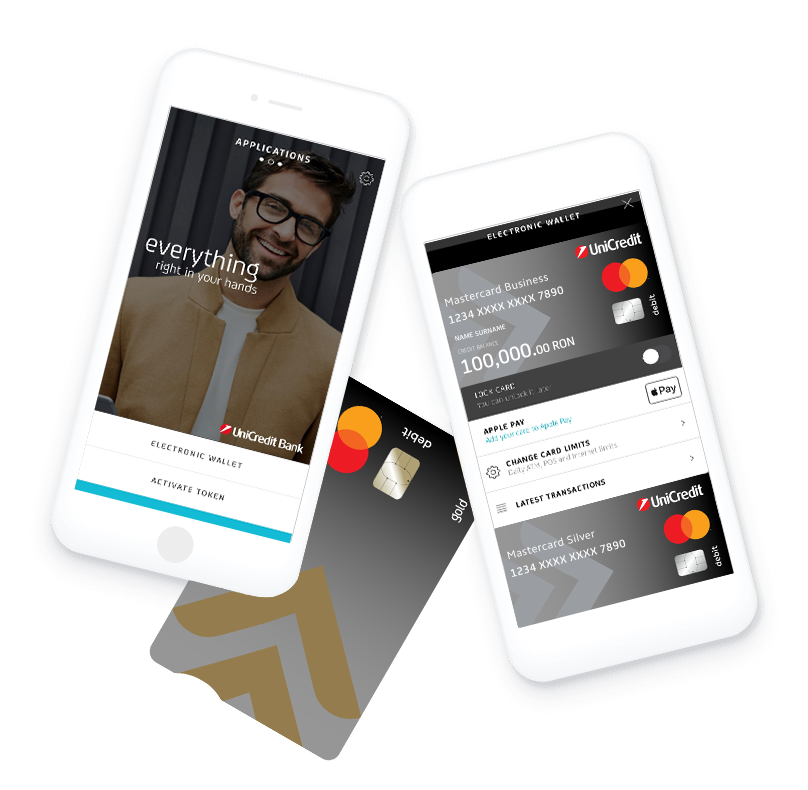

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

UniCredit Bank supports the beneficiaries of non-refundable financing through:

Facilities for ineligible expenses, including VAT:

Loading