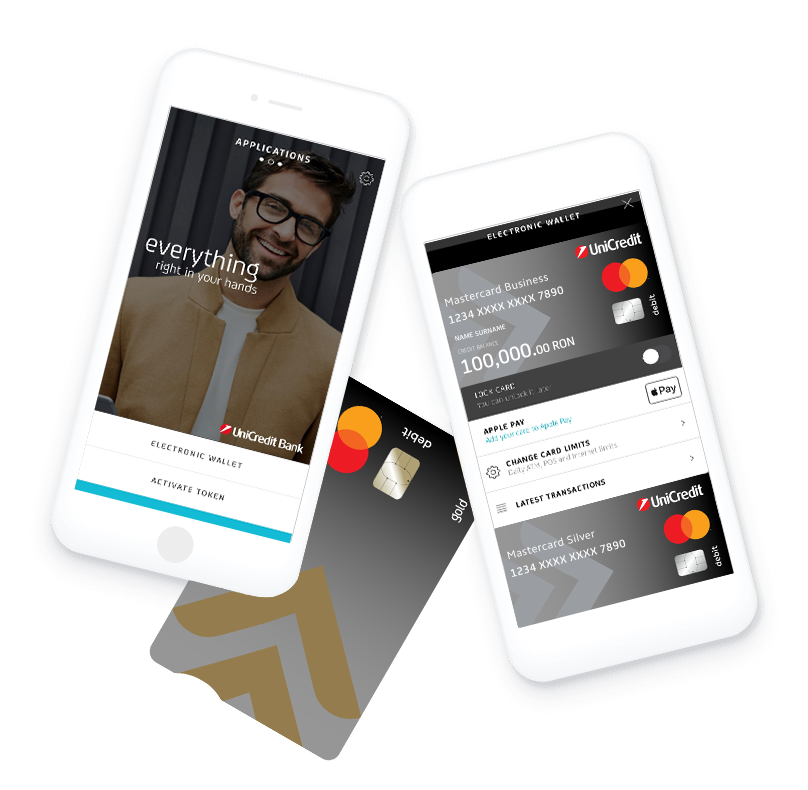

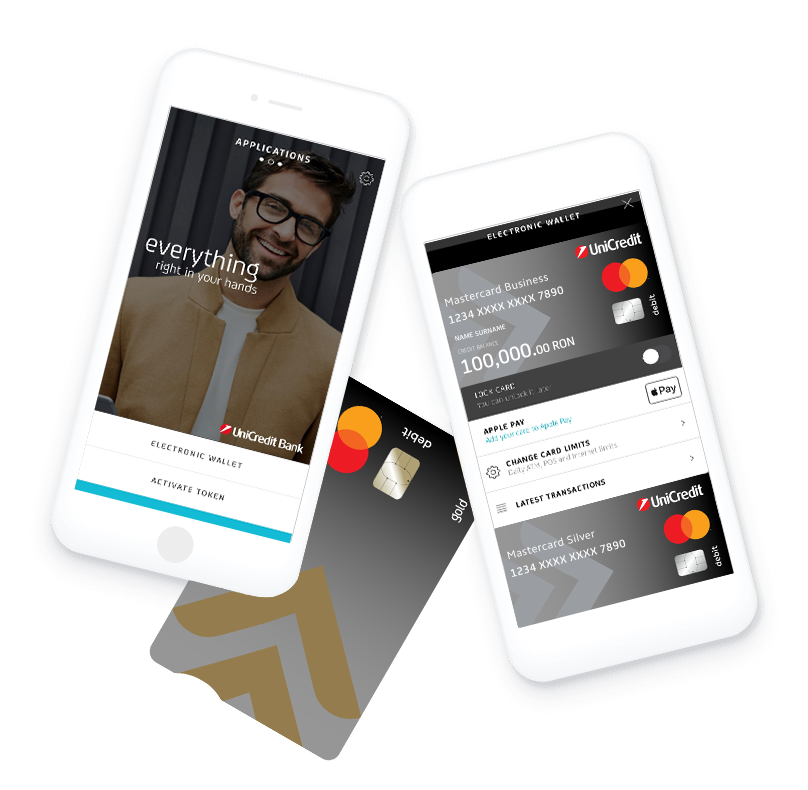

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Factoring

Factoring services can be useful for any company that sells goods or services based on deferred payment terms or that, based on the nature of its business, is primarily a buyer benefiting from deferred payment terms.

Please take a look at the series of questions and answers below that may help you with factoring operations.

The Adherent, or the Supplier, is a company that, given its business model (which is providing its clients with deferred payment terms), becomes entitled to certain receivables. In order to obtain immediate liquidity, but also to improve speed of collection, the Adherent gives the receivables to the Factor.

The Factor is a bank, or a non-banking financial institution, specialized in factoring services. As such, the Factor can pay to the Adherent the value of the eligible assigned receivables, before or upon due date, subrogated to the rights of the Adherent, and, therefore, collecting such receivables as rightful owner, from the Assigned Debtor. Such payments will be made under a pre-defined Assigned Debtor limit and at a cost.

The Assigned Debtor is the Buyer / Beneficiary / Importer of the Adherent’s goods and/or services. The sale of Adherent's goods and/or services generates the receivables assigned to the Factor.

When the Factor does not provide the Adherent with a non-payment risk coverage service, or when a commercial dispute that affects invoices for which the Factor advance funds is solved in Debtor’s favor, the Factor has a recourse right against the Adherent for such amounts. In practice, this means the Factor can ask the Adherent to reimburse any amounts advanced against receivables affected by commercial disputes or the payment of which is delayed by the Debtor over the grace period granted by the Factor to the Adherent.

The essence of the Factoring Limit and what differentiates it from other short term financing limits is its capacity to cover, at any given time, the value of goods/services invoiced and not collected from a certain Assigned Debtor.

The value of the limit is set for each Assigned Debtor, based on:

Factoring Limit = Estimated Turnover x Real Payment Term /360

Example:

Estimated Yearly Turnover = RON 2,400,000

Contractual Payment Term = 30 days

Real Payment Term = 45 days

Seasonality: June-September (120 days) account for 70% of total yearly turnover

Factoring Limit = LEI 2.400.000 x 70% x 45 / 120 = LEI 630.000

Although factoring products have a financing component, they do not represent a traditional financing, but are closer to services rendering. Consequently, according to the Fiscal Code (Law 571/2003), corroborated with the provisions of HG 44/2004 with regard to the Fiscal Code and the relevant application rules, Art. 141 paragraph 2, point 35, the VAT tax base for factoring services is the value of the service, i.e. the commission applied by the assignee, including the component afferent to the financing service.

The VAT consequently applied does not represent an extra cost. The Factor issues, at the end of each month of contract, an invoice reflecting the VAT relevant for the services rendered during that specific month. This VAT amount is deductible, according to the legislation in place.

The assignment under a domestic (both Supplier and Debtor are legal persons residing in Romania) factoring transaction cannot be banned, according to the Civil Code (art. 1.570, 1.573 and 1.578), any contractual clause stipulating such a provision being null and void:

Art. 1.570 Civil Code – Inalienability Clause

(1) The assignment that is banned or limited by means of an agreement between the assignor and debtor does not have any impact on the debtor unless:

a) the debtor agreed to the assignment;

b) the ban is not expressely mentioned in the document attesting the receivable and the assignee was not aware and was not meant to be aware of the existence of a ban at the time of the assignment;

c) the assignment regards a receivable that regards a sum of money.

The above provisions are not applicable to Public Institutions Debtors as the assignment of receivables against them is regulated by a special law, Law 121/2011. Art. 61 stipulates that, for the assignment to be oposable to the Debtor, its prior, written consent is required.

The assignment is oposable to the Debtor:

The above provisions are not applicable to Public Institutions Debtors as the assignment of receivables against them is regulated by a special law, Law 121/2011. Art. 61 stipulates that, for the assignment to be oposable to the Debtor, its prior, written consent is required.

According to OG 92/2003 on the Fiscal Procedure Code, when a company (the Supplier) does not fulfill its obligations to the local and central state budget, the fiscal authorities are authorized to start forced execution procedures, including applying a garnishment on 3rd parties (debtors) against which the Seller has uncollected receivables.

In such a case, if the respective Debtor had previously received a Notification of Assignment, stating that its debts to the Supplier became the object of a factoring contract, the Debtor has the obligation to inform the fiscal authorities that they no longer have debts to the Supplier, but to the Factor who granted a factoring facility to the latter. As such, the payment obligation of the Debtor to the Factor cannot be impacted by any later garnishment notification, regardless the enforcing party.

When talking about factoring, we do not refer to a simple financing facility, but rather to a package through which you can access ledger administration and receivables collection services, credit risk protection, as well as the possibility to collect your domestic market receivables ahead of their due date with the support of the Bank.

As member of the Romanian Factoring Association’s Board of Directors, we have quick access to market data, trends and developments, as well as to changes in the relevant legal aspects. All these translate into an increased flexibility in answering your requests in a constantly improved manner.

When talking about factoring, we do not refer to a simple financing facility, but rather to a service package through which you can access ledger administration and receivables collection services, credit risk protection and the possibility to collect your international receivables ahead of their due date with the support of the Bank. Export factoring transactions are handled by the Bank in cooperation with another factoring company, located in your client’s (the Importer) country.

As member of Factors Chain International, we have access to some 400 companies network covering more than 90 countries, which are available to manage the relationship with your international clients, thus eliminating an important set of linguistic and cultural barriers. Moreover, by using the Edifactoring system, we are able to improve collection, no matter where the funds arrive from.

Import factoring transactions are handled by the Bank in cooperation with another factoring company located in your supplier’s country. Factoring services can support importers in increasing their supplier credit value, as well as their payment terms, thus eliminating the cash-flow pressure on the company.

As member of Factors Chain International, we have access to some 400 companies network covering more than 90 countries, which are available to manage the relationship with your international clients, thus eliminating an important set of linguistic and cultural barriers. Moreover, by using the Edifactoring system, we are able to improve payments processing, no matter where the funds need to arrive.

Based on a reverse factoring agreement, made between you and the Bank, you will be provided with a without recourse factoring offer, which you can present to your suppliers. The factoring services will be provided to them by the Bank, within the limits you agree with, while the costs will be set based on the financial performance confirmed with you.

In any UniCredit Bank branch, the general factoring activity being coordinated by a specialized department, located in Bucharest, that you can contact at:

E-mail: |

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

Loading