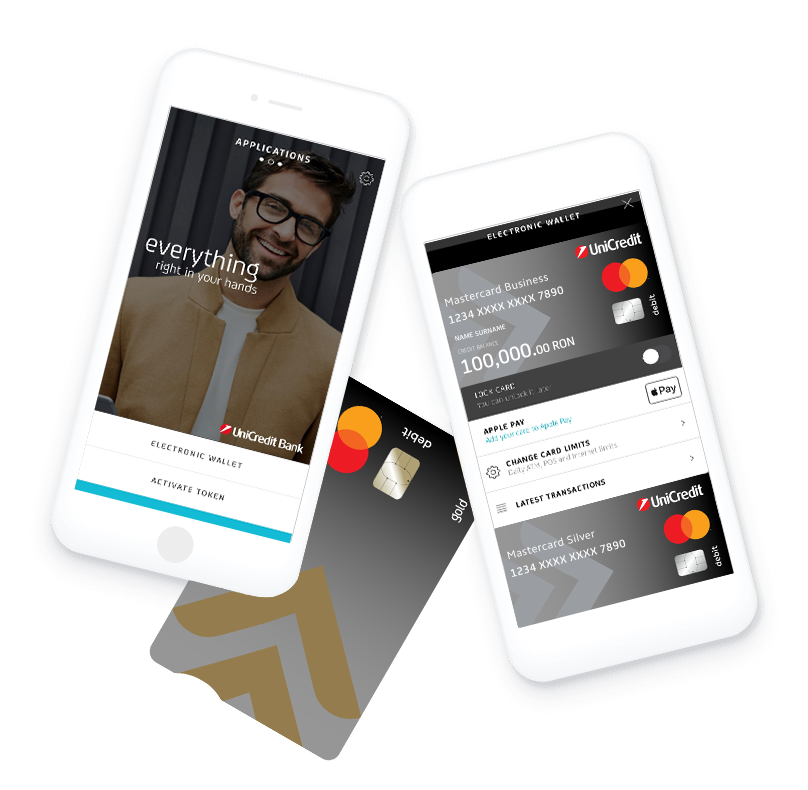

The app you are looking for

Business Mobile

ZERO administration fees, safe and secure access to your business accounts and cards, anytime, anywhere.

from UniCredit Bank

IMM Package from UniCredit Bank

| MicroStar | Creative | ||

| 45 lei/month | Free* | ||

|

For legal entities with annual |

For legal entities (including start-ups) with annual turnover < 0.5 million EUR, self-employed, PFA and NGOs |

|

Products and services |

|

|

|

Current account in lei |

2 accounts |

1 account |

|

Current account in EUR (and/or USD) |

2 accounts |

1 account | |

| Debit card | Mastercard Business Gold |

Mastercard Business Silver |

|

| Internet & Mobile banking | BusinessNet Basic / Professional with Mobile Token & Business Mobile |

BusinessNet & Business Mobile |

|

Transactions |

|

|

|

| Receipts in Lei and currency by payment order | |||

| Payments through BusinessNet from your main account | Intrabanking Lei and Currency | ||

| Interbanking Lei | Maximum 10 transactions/month | Maximum 2 transactions/month | |

| Cash withdrawals in Lei / month at UniCredit Bank/UniCredit Group ATMs and at Euronet Romania ATMs | Maximum 3 transactions | ||

| Automatic transactions through Self Service | |||

| Info SMS | - | ||

| Direct debit with UniCredit Bank partners | |||

Other benefits |

|

|

|

| Cash Back** | - | ||

Need more options in your current account package? No problem!

MicroStar current account package extras

Unlimited interbank electronic payments in Lei from accounts included in the current account package*** -> 55 Lei/month

Unlimited interbank electronic payments in foreign currency from accounts included in the current account package*** -> 65 Lei/month

Payments and receipts in Lei with cheques and promissory notes from/in the accounts included in the package*** -> 100 Lei/month

Unlimited withdrawals with the main debit card included in the current account package from any ATM in Romania -> 120 Lei/month

Additional current accounts in Lei and currency (EUR, USD, HUF, CHF or GBP) -> 12 Lei/month

In addition, by choosing the MicroStar current account package, you will benefit from dedicated fees according to the Bank's List of Fees and interest rates and for the POS Offer, consisting of transactions related to the sale of goods and/or services through POS terminals.

In case of new clients (without products/services held at UniCredit Bank) who purchase the MicroStar package, the query fee in the Trade Register database is zero and is applied only once, at the opening of the business relationship.

Creative current account package extras

BusinessNet Professional (Learn more about the BusinessNet application) ->

18 Lei/month

Additional current accounts in lei and currency (EUR, USD, HUF, CHF or GBP) ->

12 Lei/month

In addition, if you have the Creative Current Account package, you can receive CashBack, i.e. the monthly return of a portion of the bank fees charged to your account, as follows:

6 LEI if you have a credit turnover between 10.000 EUR (inclusive) and 20.000 EUR in the previous month, through UniCredit Bank accounts;

9 LEI if you have a credit turnover between 20.000 EUR (inclusive) and 30.000 EUR in the previous month, through UniCredit Bank accounts;

15 LEI if you have registered in the previous month a credit turnover higher than 30.000 EUR (inclusive), through UniCredit Bank accounts.

Optimised transaction costs

A wide range of products and services for your current business

Services adaptable and optimised to the specifics of your business

*In the case of Legal Entities, companies with registered offices in Romania, established and registered in accordance with the provisions of Law 31/1990 or Foreign Legal Entities and their branches/representatives, regardless of the place of registration, the standard price of the package starting on 03.03.2025 is 0 RON/month for the first 12 months from the opening date of the package, respectively 20 RON/month starting with 13th month.

**Monthly return of a portion of the bank fees charged to your account as follows:

✓ 6 LEI if you have a credit turnover between 10.000 EUR (inclusive) and 20.000 EUR in the previous month, through UniCredit Bank accounts;

✓ 9 LEI if you had a credit turnover between EUR 20,000 (inclusive) and EUR 30,000 in the previous month, through UniCredit Bank accounts;

✓ 15 LEI if you have registered a credit turnover of more than 30.000 EUR (inclusive) in the previous month, through UniCredit Bank accounts.

***The fees and discounts refer exclusively to commissions charged by UniCredit Bank. They do not apply to the Sent/ ReGIS commission, i.e. the correspondent bank commission. For products or services that are not included in the package, standard fees and commissions apply according to the list of commissions and rates in force.

Loading