The Full Option App for your money

Everything you want and didn't know you wanted from Mobile Banking

Get your Mobile Banking app and discover a user-friendly interface and information that matters, at your fingertips. With the essential features for remote banking the way you want it and an intuitive digital payments menu, you're in control of your finances.

100% Mobile Banking Credit: Now you can take out a Personal Achievement Credit even easier, directly from the app, without file analysis fees, without trips to the bank, anytime you want, from wherever you are.

100% Mobile Banking Credit Card: You can apply for your credit card directly from your mobile phone, accessing the offer from the Mobile Banking app, through a 100% digital workflow.

Advantageous interest rate: You can digitally open a deposit in LEI, through Mobile Banking, enjoying 0.3 percentage points compared to the standard interest rate offered in branch for 3, 6 and 12 month deposits in Lei.

Mobile Banking for Kids Banking: With the Mastercard Young card you have access to Mobile Banking to view your transactions at any time. For added security, parents have additional rights to make changes to their children's Mobile Banking. For example, they can change transaction limits or refuse online payments.

You can request up to 5 virtual cards attached to each account in RON or EUR. Virtual cards are issued instantly and can be managed directly from Mobile Banking, available 24/7.

You have ZERO costs* when issuing and renewing UniCredit Bank virtual cards, easy to use at the POS via Apple Pay or Google Pay, but also for digital transactions.

Quickly and easily transfer money to your UniCredit account from other bank accounts and enjoy current account offers and better interest rates for your future borrowing plans.

With the Add Money program, transfers are made quickly and securely through Mobile Banking, without us charging you any commission.

Forget your wallet, cards and PINs. Your phone is always at your fingertips and you can withdraw cash whenever you want from your current account, safely and securely from UniCredit Bank ATMs and cash dispensers (BNAs) using the new option in the Mobile Banking app: mCash

If you have a current account with UniCredit Bank, through the Happy Hour Exchange program, you can make a LEI-EUR or LEI-USD currency exchange transaction through Mobile Banking or Online Banking**, at the exchange rate published by the BNR, every working day, between 13:15 and 14:15, up to a limit of 1.000 EUR/one transaction/day (or the equivalent in EUR at the BNR exchange rate of the amount of the currency exchange).

Facility offered under the Happy Hour Exchange Rate Beneficiency Programme. Exchange rate published by the NBR - exchange rate calculated and published by the NBR, every banking day, at 13:00, based on the exchange market quotations.

More details about the Happy Hour Exchange.

Through the ShopSmart program in the Mobile Banking app you buy and get a part of your money back. You benefit from offers on your favourite brands and you can earn cashback or loyalty points with every UniCredit card purchase.

Read more details about the ShopSmart program.

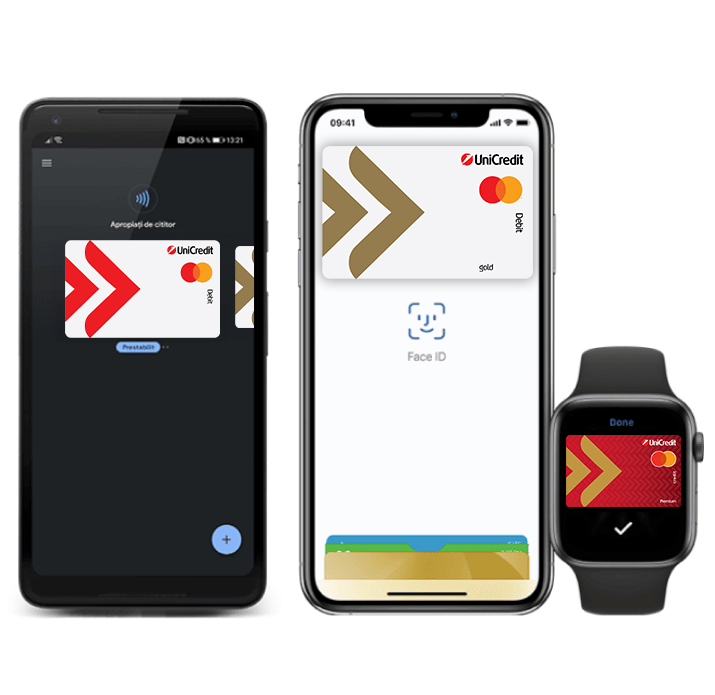

From now on, make fast and secure digital payments with Google Pay and Apple Pay directly from Mobile Banking.

1.

CHECK your account balance

TRACK your monthly expenses

GET free push alerts for transactions made on your current or savings accounts and with your unicredit cards (debit, credit, menu card)

OPEN YOUR SAVINGS ACCOUNT directly from the app

REQUEST debit card replacement

CARD activation/blocking/unblocking

VIEW all card details in the Cards Section

CHANGE limits for pos, atm, internet card payments

PAY utility bills to approved suppliers quickly and via Scan & Pay

2.

CHARGE your credit card

YOU are partially/entirely repaying the loans you have with UniCredit Bank

YOU cancel pending payments (in LEI)

DONATE to associations, as you prefer

ACTIVATE direct debit mandates

SEND confirmation of payment order

INSTRUCT scheduled payment orders in RON

MAKE PAYMENTS TO THE TREASURY without having to go to the counter of public institutions or to the branch office

ACTIVATE the application yourself in case you change/return/lose your phone.

UPDATE your identity card

1.

CHECK your account balance

TRACK your monthly expenses

GET free push alerts for transactions made on your current or savings accounts and with your unicredit cards (debit, credit, menu card)

OPEN YOUR SAVINGS ACCOUNT directly from the app

REQUEST debit card replacement

CARD activation/blocking/unblocking

VIEW all card details in the Cards Section

CHANGE limits for pos, atm, internet card payments

PAY utility bills to approved suppliers quickly and via Scan & Pay

2.

CHARGE your credit card

YOU are partially/entirely repaying the loans you have with UniCredit Bank

YOU cancel pending payments (in LEI)

DONATE to associations, as you prefer

ACTIVATE direct debit mandates

SEND confirmation of payment order

INSTRUCT scheduled payment orders in RON

MAKE PAYMENTS TO THE TREASURY without having to go to the counter of public institutions or to the branch office

ACTIVATE the application yourself in case you change/return/lose your phone.

UPDATE your identity card

3.

1.

CHECK your account balance

TRACK your monthly expenses

GET free push alerts for transactions made on your current or savings accounts and with your unicredit cards (debit, credit, menu card)

OPEN YOUR SAVINGS ACCOUNT directly from the app

REQUEST debit card replacement

CARD activation/blocking/unblocking

VIEW all card details in the Cards Section

CHANGE limits for pos, atm, internet card payments

PAY utility bills to approved suppliers quickly and via Scan & Pay

2.

CHARGE your credit card

YOU are partially/entirely repaying the loans you have with UniCredit Bank

YOU cancel pending payments (in LEI)

DONATE to associations, as you prefer

ACTIVATE direct debit mandates

SEND confirmation of payment order

INSTRUCT scheduled payment orders in RON

MAKE PAYMENTS TO THE TREASURY without having to go to the counter of public institutions or to the branch office

ACTIVATE the application yourself in case you change/return/lose your phone.

UPDATE your identity card

3.

4.

If you are already a UniCredit customer (UniCredit Bank or UniCredit Consumer Financing SA) and have a debit or credit card, you can activate the Mobile Banking app with your personal data only..

For this authentication process you only need your debit or credit card issued by UniCredit Bank or UniCredit Consumer Financing and, of course, internet access.

You can activate the application yourself by following the steps below:

In case you need assistance activating the application, call the InfoCenter available 24 hours a day on +4021.200.2020 (normal rate call in Telekom Romania fixed network) or *2020 (normal rate call in Orange, RCS&RDS, Telekom Romania, Vodafone mobile networks) and our colleagues will help you activate the application.

Or apply online and we will contact you:

* The complete list of fees and interest rates charged by the bank for individual customers can be consulted in any branch of the bank and on www.unicredit.ro, section Useful Documents.

**Online Banking - Internet Banking service.